We compared America’s present economic situation that America and the rest of world find themselves in, to one in the grip of a multi-headed hydra, each head operating independently. Collectively they threaten to tip the entire world into recession, even if its for a short duration. We have identified a set of risk-drivers that we believe are acting in parallel paths to create a recessionary scenario.

RISK-DRIVER #1: Global Oil Supply Shortage

Banking sanctions have threatened to cut off a significant supply of oil coming into world markets from Russia. The US had been especially reluctant to avoid any direct sanctions on energy sources given the global panic in oil markets playing out presently. However, in the scenario playing out now, an embargo on Russian oil exports is real, and a large part of that volume now fails to reach the market. According to Pierre Andurand, one of the oil sector’s best-known hedge fund managers, supplies of Russian oil into Europe would disappear in the aftermath of Vladimir Putin’s invasion of Ukraine, leading to a lasting reshaping of global energy markets.

Barring a scenario where Russian output (at heavily discounted prices) is absorbed by China and India leaving OPEC & OPEC+ supplies available to feed rest of the world, we are looking at a worrisome situation.

Barring a scenario where Russian output (at heavily discounted prices) is absorbed by China and India leaving OPEC & OPEC+ supplies available to feed rest of the world, we are looking at a worrisome situation.

Russia produces about 10.5 millions barrels/day, and exports about 5.5 million bpd. (Russia is the world’s top exporter of crude and oil products combined, at around 7 million barrels per day (bpd ) or 7% of global supply.)

Even after excluding the 1 million bpd still flowing through pipelines, the spare capacity available among oil majors Saudi Arabia, UAE and little bit from OPEC+ countries is barely enough to cover about 2 million bpd of the 4 million bpd shortfall.

The IEA’s recent comment about the ability of OPEC+ countries to improve production says it all – “chronic OPEC+ under-performance versus targets that has taken 300 million barrels of oil off the market since the start of 2021.”

- “The result would be a rise in oil prices well past the current 125/bbl to over 150/bbl within a short time.” (Amrita Sen – CEO, Energy Aspects).

- Oil could hit a record $185 a barrel by the end of 2022 if disruption to Russian exports lasts that long. (JP Morgan prediction)

- “We expects crude to hit $200 in the event of a complete energy embargo by the West.” (CEO of Pioneer Energy, a top shale oil producer)

- Pierre Andurand, one of the oil sector’s best-known hedge fund managers: “I think we’re losing the Russian supply on the European side for ever.” Crude could even hit $250 barrel this year, double current levels.”

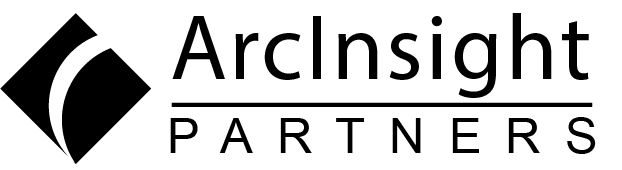

Russia supplies 40% of Europe’s gas, in addition to being a major supplier of oil.

Germany had been the biggest obstacle to the EU joining the U.S. and U.K. boycott on liquid fuels. That means that Europe has to replace over 2 million barrels of oil and products a day from elsewhere. That will push global prices higher because Russia is not able to redirect all of the production that it will no longer be able to sell in Europe. With its storage tanks full and pipelines backed up, the country will have to cut production.The problem is particularly acute with regard to diesel, where Russia had a dominant position on the European market before the war.

Russia is also the world’s largest grains and fertilizers exporter and a top producer of palladium, nickel, coal and steel. Russia ranks number one, two and three, respectively, among the world’s exporters of natural gas, oil and coal. Europe gets the bulk of its energy from its eastern neighbor. Russia also accounts for half of America’s uranium imports. It supplies a tenth of the world’s aluminium and copper, and a fifth of battery-grade nickel. The bid to exclude its economy from the trading system will hit a wide range of industries and add to global food security fears.

The one wildcard the world must now look to is the role that US shale producers might play in this scenario.

US oil production is currently 11.6mn barrels a day, well below its pre-pandemic peak near 13mn b/d. U.S. shale oil producers would need to add the equivalent of Russia’s entire crude oil production within just seven years to head off a global shortage. However, oil prices in the futures market would need to rise significantly before the US shale industry could increase production and deliver the cash returns expected by investors.

According to the International Energy Agency, a global oil shortage is coming by the mid-2020s. Because of the current low number of newly approved drilling projects in countries such as Saudi Arabia or Russia, the world can expect a supply crunch developing by the mid-2020s.

“There is simply no oil source or oil investment large and productive enough to get us through this supply crisis. Capital has dried up for projects involving energy investments. Energy security has been shocked by the Russian invasion, and underscores how important energy flows are to global stability and security. ” (Dan Yergin, economist)

The potential supply impacts are so large that there isn’t a quick way to substitute in the medium term, meaning the only mitigant will be price inflation of these inputs and the products that depend on them. It would take Europe more than a year to replace the volume of oil it receives from Russia and it would have to pay significantly higher prices.

Releasing Iran from international sanctions is being discussed. High oil prices are set to trigger investment to ramp up U.S. shale oil production. But these sources of supply optimism may not be set to come online soon enough to replace Russian output.

That the U.S. shale oil producers have the ability to make up the global supply difference is a theory would be severely tested as between now and 2025 a scenario in which the U.S would need to add more than 10 million barrels per day.

The Pioneer Energy CEO acknowledges in the event of any oil embargo, the industry simply would be unable to plus the supply gap quickly. America’s shale oil operators normally expect a 2-3 year plan for long term production increases. Adding a drilling rig takes six to eight months before it gets to first production. Additionally, the shale oil patch has been hampered by supply chain constraints – labour shortages, frack fleet shortages, rig shortages, and sand shortages. Then there’s demands from Wall Street that operators use their oil price windfall to pay dividends rather than drill more wells would require them many months to even sharply boost output.

Shale regions such as western Texas expect to increase output by about 700,000 b/d this year, Even doubling that production rate to 1.4 million bpd in 2023 and 2024 would require a global coordinated effort, and still not meet the entire shortfall. We need to add probably two, two and a half million barrels a day, according to Pioneer Energy.

A potential solver in this market is demand destruction – whether as an economic response to the Fed’s planned interest rate rise or artificially induced by deliberately aggressive timing and severity of such interest rate rises.

Tapping into strategic oil reserves, as the U.S. has already begun doing, and balancing market demand for oil with existing stocks can help soften the impact of the supply shock. But the IEA also sees a potential opportunity for countries to expand their renewable energy infrastructure amid the uncertainty surrounding oil. Indeed, today’s alignment of energy security and economic factors could well accelerate the transition away from oil. The EU is targeting for 32% of its energy to be generated by renewable sources by 2030, with a big focus on solar energy and both onshore and offshore wind power.

Meanwhile the International Energy Agency (IEA) also predicts robust demand growth for oil over the next few years driven by the rise in industry, aviation, and petrochemical needs. The group’s annual World Energy Outlook, is looking at energy demand to grow by more than a quarter between 2017 and 2040. And that figure doubles if there is no improvement from current levels of energy efficiency.

For a deeper insight into the evolution of today’s oil & energy markets, I strongly recommend reading through yet another one of Daniel Yergin’s gems – The New Energy Map reviewed by ArcInsight Research analysts in Jan 2022.

RISK-DRIVER #2: Collateral Damage to Sovereign Ratings

Lower prices is crucial to providing a boost to economic growth, especially in big oil-buying countries such as India. However, the impact of sanctions will hit these countries indirectly from another unintended malaise.

The U.S. has sanctioned Russia’s sovereign debt while major ratings agencies slashed Russia’s sovereign rating to junk status. Economist Stephen Roach of Morgan Stanley warns that effects from any default on Russia’s sovereign debt as a result of the Ukraine crisis could well spill over to emerging markets, including China. If Russia does default on its debt, there will be broad spillover effects to sovereign debt in emerging markets around the world and China will not be immune from that.

The U.S. has sanctioned Russia’s sovereign debt while major ratings agencies slashed Russia’s sovereign rating to junk status. Economist Stephen Roach of Morgan Stanley warns that effects from any default on Russia’s sovereign debt as a result of the Ukraine crisis could well spill over to emerging markets, including China. If Russia does default on its debt, there will be broad spillover effects to sovereign debt in emerging markets around the world and China will not be immune from that.

“Whilst the US, western Europe and wealthier countries in the world will be able to afford some of these tax breaks, print some money . . . those poorer nations won’t have the same toolbox. .These are going to be the people who suffer first and these are some of the unintended consequences of the policies that are likely to come.”

A feasible solver in this market is demand destruction – whether as an economic response to the Fed’s planned interest rate rise or artificially induced by deliberately aggressive timing and severity of such interest rate rises.

RISK-DRIVER #3: Rising and Persistent Inflation

The other nearer-term risk-driver that points to a global recession, not the least of which is enabled by high oil prices. Inflation is regarded as costly because it erodes people’s savings and distorts price signals. Inflation is thought to be something of a self-fulfilling prophecy. When the public thinks the cost of living will be higher, they adjust their behavior accordingly. Businesses boost the prices they charge and workers demand better wages. That rinse-and-repeat cycle can potentially drive inflation even higher.

The huge input price increase that oil and gas represent will lift price inflation without helping wage inflation thereby causing even worse imbalance between the two, expect your purchasing power to go down and expect a global stagflationary environment with high input prices and low spending power.

The huge input price increase that oil and gas represent will lift price inflation without helping wage inflation thereby causing even worse imbalance between the two, expect your purchasing power to go down and expect a global stagflationary environment with high input prices and low spending power.

In the current environment, commodities prices are the main event for monitoring hints that the effects of demand destruction are gaining momentum. At some point, high prices will soften demand so that prices peak, which in turn has broad implications for markets and macro. That tipping point still lies in the future, but given the rapid increase in many key commodities prices in recent months it’s no surprise that hints of demand destruction are starting to emerge.

According to Goldman Sachs economists, the jobs gap is a situation the Fed must address or risk persistent inflation. Taking the gross domestic product growth down to the 1%-1.5% annual range should work to slow down the jobs market.

Time and again, economic and financial markets experts such as Mohd. El-Erian of Allianz and Prof. Jeremy Siegel at the Wharton school have warned of serious missteps by the US Federal Reserve. With natural gas prices hitting all-time highs, soaring energy costs are expected to push inflation above 7% on both sides of the Atlantic in the coming months and eat deep into households’ purchasing power. American with incomes of at least $100,000 saying they’ve cut back on spending according to one survey. It also shows that higher-income consumers are showing signs of financial stress and have begun cutting back on dining out, travel and vacations, and cars.

Financial stress points are not limited to lower-income consumers. The survey finds American with incomes of at least $100,000 saying they’ve cut back on spending, or may soon do so, in numbers that are not far off the decisions being made by lower-income groups. The high-income consumer demographic represents only one-third of consumers. However it is responsible for up to three-quarters of the consumer spending in America.

In the U.S., the Fed estimates that every $10 per barrel rise in oil prices cuts growth by 0.1 percentage point. And as a rule of thumb, every 10% rise in the oil price in euro terms increases euro zone inflation by 0.1 to 0.2 percentage point. Consumer prices across the OECD club of mostly rich countries are rising by 7.7%, year on year, the fastest pace of increase in at least three decades. In the Netherlands, inflation is nearing 10%, even higher than in America, while in Estonia it is over 15%.

In addition to being a major supplier of oil and gas, Russia is also the world’s largest grains and fertilizers exporter and a top producer of palladium, nickel, coal and steel. The bid to exclude its economy from the trading system will hit a wide range of industries and add to global food security fears.

In addition to being a major supplier of oil and gas, Russia is also the world’s largest grains and fertilizers exporter and a top producer of palladium, nickel, coal and steel. The bid to exclude its economy from the trading system will hit a wide range of industries and add to global food security fears.

The Fed’s decision to prolong tapering of the Covid-induced fiscal stimulus, and its acting very late to reverse the incessant Fed balance sheet expansion despite extremely worrisome inflationary trends (inflation rate has been moving beyond the 4-5% range in US) in the US economy, has created massive bubbles in asset prices – both real and financial. At a time when the Fed should have been ahead of the curve and begun raising rates by atleast 50 basis points as a first step, the Russia-Ukraine crisis has again muddied the decision picture.

Inflation is a very sticky problem and tends to stays high even after raising rates sufficiently. The Russian-Ukraine crisis however, allows the Fed to enjoy a reprieve from blame. Higher oil prices has a malignant effect on economic activity Higher input costs for goods, higher labor costs for services and the inability to pass them onto consumers in the short run cuts into margins and profitability. Additionally, an inflation-caused reduction in purchasing power of consumers points to an economic scenario of significant demand destruction in the short run. In the coming months, there is a high risk of stagflation, or little to negative growth coupled with high inflation.

Yet again, the one remaining solver available for this economic equation might be to tip the economy (whether unintentionally, or by conscious design) into deep recession in an effort bring overall prices down. However short that recession might be, or long.

Here are some recent examples that suggest the forces of demand destruction are on the rise.

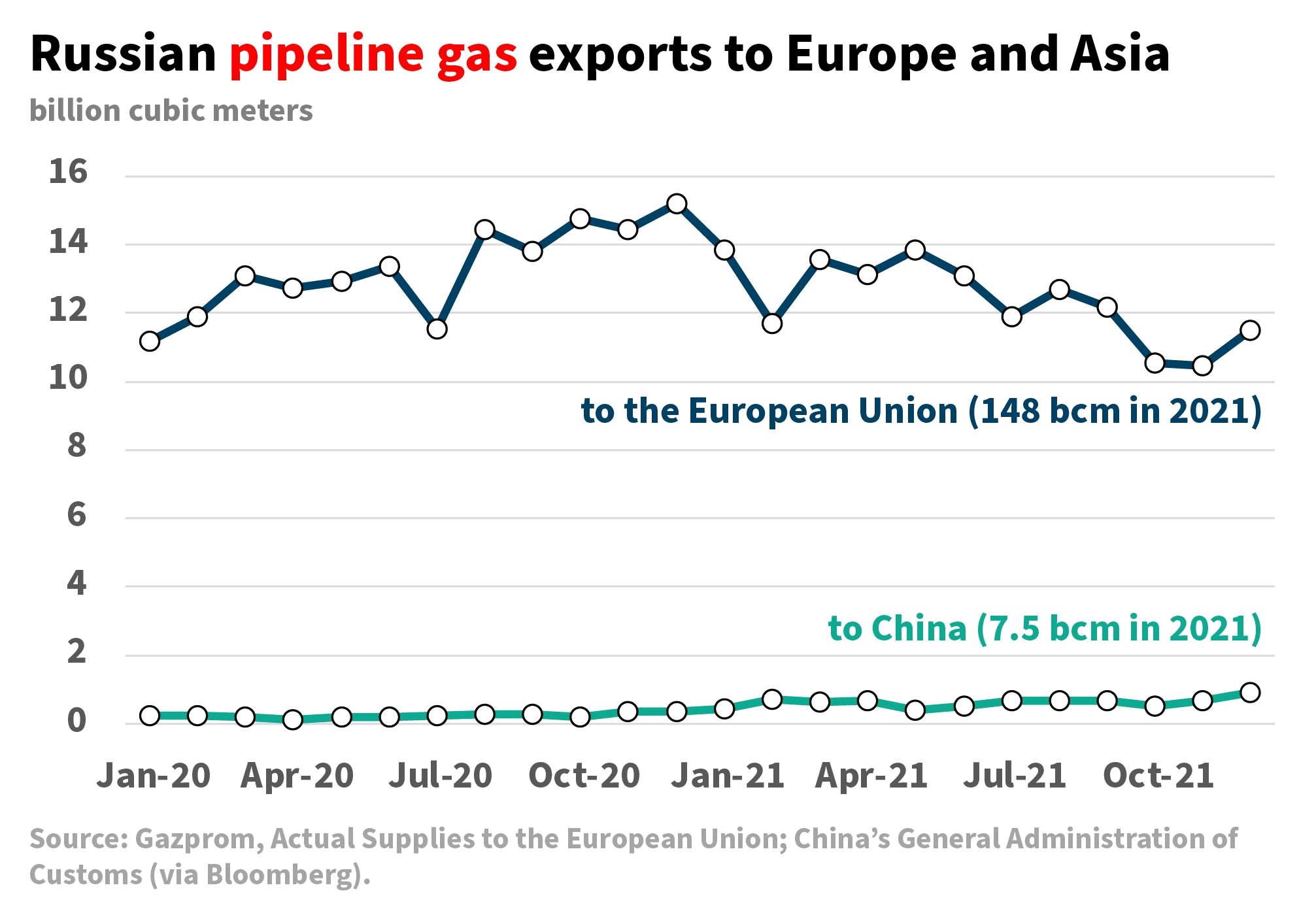

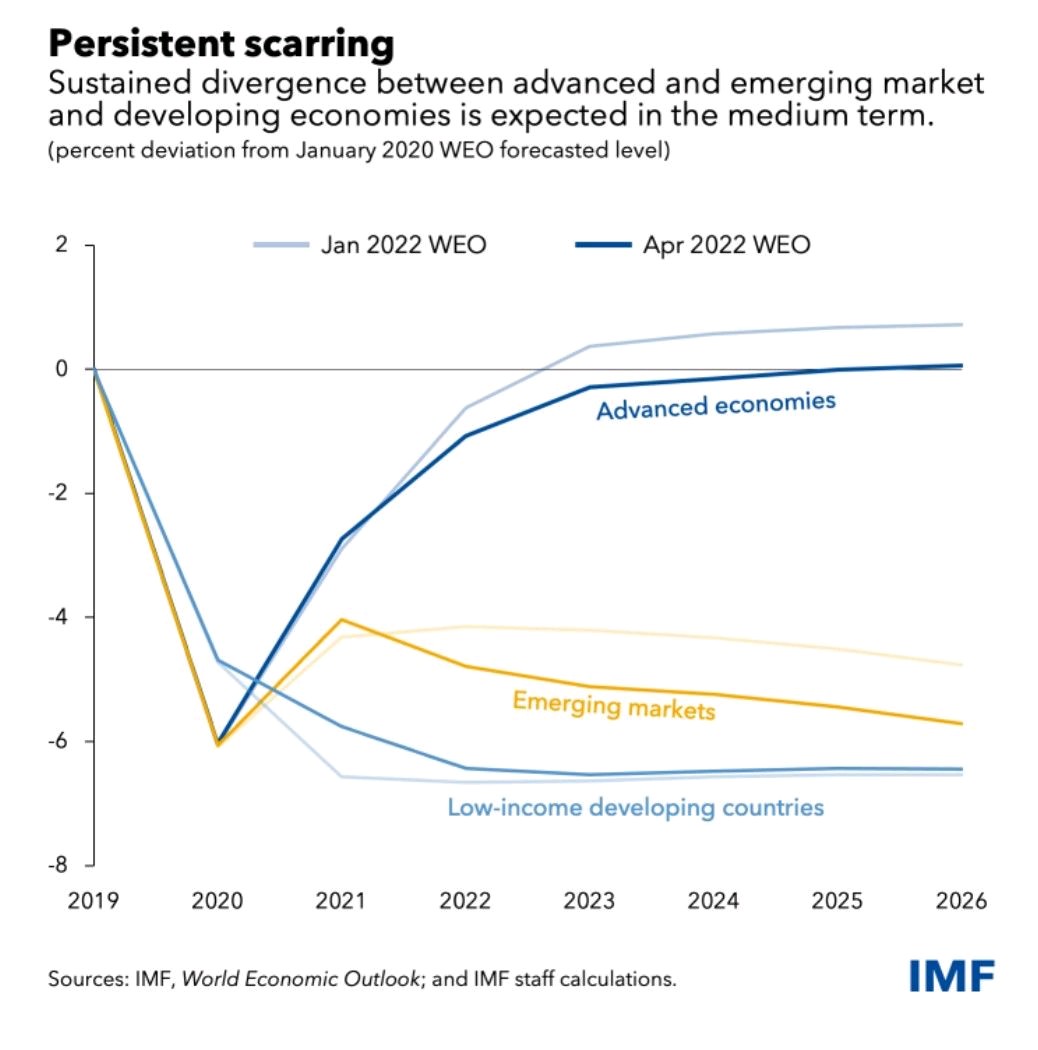

Global economic growth estimates continue to fall. The International Monetary Fund on Tuesday cut its forecast for global growth to a 3.6% increase in GDP for this year and 2023, which marks a 0.8 and 0.2 percentage point slide, respectively, from the estimates published in January. “Global economic prospects have been severely set back, largely because of Russia’s invasion of Ukraine,” advises Pierre-Olivier Gourinchas, economic counsellor at the IMF.

Surging energy costs are driving inflation higher and appear to be pinching discretionary consumer spending. The sharp rise in headline inflation is directly tied to the recent increase energy prices. In turn, the higher costs of producing and transporting a range of goods is starting to show up in consumer spending data. US retail sales reports show a strong rise in dollars spent on gasoline, which crowds out spending in other retail sectors. Energy overall is only about 6% of the consumer spending. But when you add other things like food and housing, that jumps to 47% of consumer spending. And so we’re seeing all of these prices rise.

The rise in inflation is driving up mortgage rates and creating headwinds for the housing sector. Higher rates will ‘work’ largely by depressing housing construction, which is already too low. We’re probably going to start to see the beginning of some demand destruction in the housing market because of the rise in mortgage interest rates.

Afterthought: The U.S. Federal Reserve is finally signalling a plan to engineer a soft recession for the economy as it hikes interest rates to fight inflation. Fed Chair Jerome Powell is prepared to move “expeditiously” to manage the highest inflation in 40 years by using bigger-than-usual interest rate hikes if needed.

RISK-DRIVER #4: The Wildcard Risk

CHINA is our wildcard multi-headed risk driver, much like the hydra we mentioned about earlier.

(a) China’s Tech Behemoths Are Under Attack: The China economy has traditionally been heavily dependent on its tech-heavy growth-heavy behemoths. The future of those very same behemoths have been put at risk by threatening policy postures by the Chinese Communist party. This has placed a cloud on their future prospects and spooked global investors in those companies. (Afterthought: The Chinese Communist Party has signaled very recently a willingness to ease up their pressure on China’s large tech players and back off from their tough and disruptive regulatory stance.)

(b) China’s Perceived Role In Russia-Ukraine Crisis: Going by its recent decisions to provide economic support to Russia in the wake of its invasion of Ukraine, the country is widely perceived as playing for the wrong team, in the face of an environment of heavy economic sanctions.

(c) China’s Debt Crisis: A long brewing crisis in China’s real estate market brought on by an unending financial support for an indiscriminate building boom, often  following an absurd logic has now come back to haunt its economy. Hundreds of smaller Chinese towns now have massive commercial and residential hubs. Just one problem. There is not enough economic activity or willingness of people to move in to take advantage of them. The result has been dazzling ghost towns and hundreds of billions in unpaid debts sitting on balance sheets of its largest real estate developers that have no chance of being repaid. Evergrande, The single largest player real estate player in China has a past due debt of over US $300 billion. The impact of that default risks setting off economic shock-waves across China’s domestic banking sector and international real estate investors, closely followed by their impact on companies that were once part of Evergrande’s supply chain (and now sitting on huge unsettled account receivables). This debt crisis threatens to severely dent the country’s economic picture despite the government’s desperate efforts to prop up the economy via economic stimulus packages and keeping interest rates as low as possible.

following an absurd logic has now come back to haunt its economy. Hundreds of smaller Chinese towns now have massive commercial and residential hubs. Just one problem. There is not enough economic activity or willingness of people to move in to take advantage of them. The result has been dazzling ghost towns and hundreds of billions in unpaid debts sitting on balance sheets of its largest real estate developers that have no chance of being repaid. Evergrande, The single largest player real estate player in China has a past due debt of over US $300 billion. The impact of that default risks setting off economic shock-waves across China’s domestic banking sector and international real estate investors, closely followed by their impact on companies that were once part of Evergrande’s supply chain (and now sitting on huge unsettled account receivables). This debt crisis threatens to severely dent the country’s economic picture despite the government’s desperate efforts to prop up the economy via economic stimulus packages and keeping interest rates as low as possible.

(d) China’s Renewed Covid Surge: China which emerged first out of the gates from the initial pandemic that originated in Wuhan is now facing a renewed surge that is threatening its key economic regions most notably the important technology hub and shipping ports of Shanghai. Added to that, China’s “no-Covid policy” that brings down disproportionate measures to control infection cases, has effectively shut down much of the economic activity in the very important link in the global supply chain system. The immediate cause of China’s slowdown is blowback from a rebound in the coronavirus. The government is already downsizing its target year-on-year increase in GDP.