Rebecca A. Fannin is a leading expert on global innovation. As a technology writer, author and media entrepreneur, she began her career as a journalist covering venture capital from Silicon Valley. Following the VC money, she became one of the first American journalists to write about China’s entrepreneurial boom, reporting from Beijing, Shanghai and Hong Kong. Her book is a journalistic journey through the immense strides China’s technology sector has made in recent years, the underpinnings of that growth, the vaunted technology players that are now giving American technology players a run for their money.

As we work through the China developments shared by Rebecca Fannin, we have chosen to intersperse thoughts from another AI/Emerging Tech. expert, unabashed China-cheerleader and a former head of Microsoft’s AI business Dr.Kai-fu Lee, who published a book on very similar lines last year titled AI SUPERPOWERS.

THE COPY-&-PASTE MODEL OF CHINESE INNOVATION: ITS ALL IN THE PAST

One of the bigger misconceptions about China’s tech market is that China is all about copying – and stealing ideas. But if that was ever the case, it certainly isn’t now. China entrepreneurs have proven that they can innovate. Leapfrogging to “Copied from China” In less than two decades, China tech innovation gone through three phases of development: from copy to China, to invented in China, and now today, the biggest trend to watch is copied from China, meaning US companies duplicate Chinese innovations. In fact, they’ve become so good at it that the West is now copying their ideas.

China’s first-generation internet entrepreneurs unabashedly created copies of successful American startups Yahoo!, Amazon, Facebook, Google, and eBay. Intellectual property protections were scant. Now Chinese technocrats are breaking boundaries with their own disruptive innovations, taking them overseas and getting copied by Westerners. Chinese internet companies are no longer dismissed as mere copycats of Google, Facebook, YouTube, and Amazons they were back in 2008.

Now, made-in-China business models built for a mobile-first generation are advanced and widely used. There are multi-functional superapps, mobile wallets, mobile shopping in groups, mobile videos and streaming, mobile books, and mobile news apps with no editor. This world-on-a-screen is extended by social sharing features baked into these apps.

No other country in the world can match China’s startup zeal. Founders in Beijing, Shanghai, Hangzhou, Shenzhen, and Chines tier-two cities are tireless, persistent, and driven to succeed.

THE TIK TOK CASE STUDY Chinese entrepreneurs such as ByteDance founder Zhang Yiming are showing that they can succeed in an openly competitive market internationally rather than only in China where the Great Firewall regulates the internet and blocks access to several U.S. social media sites. Few tech startups have taken off as quickly as Beijing-based ByteDance, the creator of the highly popular 15-second video app, TikTok. In just two years, TikTok has emerged to rival companies like Netflix, YouTube, Snapchat, and Facebook with more than one billion downloads in 150 markets worldwide and 75 languages. More later.

INTENSE WORK CULTURES. CUT-THROAT DOMESTIC TECH RIVALRIES.

Founders in Beijing, Shanghai, Hangzhou, Shenzhen, and Chines tier-two cities are tireless, persistent, and driven to succeed. Its not of failure here; it’s the fear of missing out. Entrepreneurs and investors schooled in the West at elite universities such as Stanford. Startup teams in China routinely work “996,” as it’s commonly referred to in tech circles – the industry’s ‘996’ work schedule, which refers to the 9 a.m. to 9 p.m. workday, six days a week.

. It’s a reminder of Silicon Valley allnighters during the time when China’s entrepreneurial boom was beginning out after the 1990s dotcom boom. “China and the US are at different points of eco nomic development and motivation. China’s entrepreneurial culture does make Silicon Valley look sleepy,” says Hans Tung of venture investment firm GGV Capital in Menlo Park.

Kai-fu Lee echoes the same sentiment in his book too – “survival in the internet coliseum required relentlessly iterating products, controlling costs, executing flawlessly, generating positive PR, raising money at exaggerated valuations, and seeking ways to build a robust business “moat” to keep the copycats out”. China’s digital giants (Alibaba, Tencent, Didi) are the champions of a ferocious market. They have beaten off tens if not hundreds of competitors. So when a company like Didi takes on Uber in Mexico and Brazil, always bet on the Chinese company. And they aren’t just good at competing and coding. They are also good at navigating messy markets and responding to dirty tricks.

GAINING FAST – CHINA’S NEXT TECH TITANS: In the race to own it all, Alibaba and Tencent clash frequently in mobile payments, messaging, and mobile commerce. Alibaba, the master of online services for sellers to become faster, smarter, and more productive, is pushing into Tencent turf in social networking with DingTalk, a messaging app for the workplace. Tencent, the leader of digital content and entertainment, is playing in Alibaba’s sandbox by launching WeChat minishops. Baidu is largely staying out of the fray, focused on Al for autonomous driving and smart-home devices for lighting and speakers.

New rivals are ready to pounce on China’s BAT companies if they slip up. But it won’t be easy to penetrate their league. The clubby network effect in China is just as strong as it is in Silicon Valley. Similar to PayPal’s so-called mafia, the BAT trio and their alumni represent 42 percent of China’s venture investments, one in five top Chinese startups, and 30 percent of funding in Chinese startups.

Copying from China China’s rough-and-tumble environment toughens up entrepreneurs and forces them to get new ideas into the marketplace fast and first often ahead of US counterparts, which are today ending up as the copycats. Notably, Facebook has been studying China for clues. Facebook redid its social media site to integrate private messaging, group chats, and payments that resemble innovations that WeChat pioneered years ago. Facebook has also tested its own digital gift feature.

CHINA’S PIONEERING CONSUMER TECH MODEL

The BAT have the best of both worlds. These three companies have scaled up in their protected home markets with little overseas competition, tapped the Western capital markets with IPOs, and used the money to bulk up with billion-dollar acquisitions and chunks of the most promising, innovative tech companies, in effect paying a large tuition to gain knowledge on what makes Silicon Valley tick. They are innovating in ways that are tuned to China’s fast-paced digital culture and slowly filtering into the West. Their sprawling size and take-all competitive thrust has major implications for the US tech industry and for US consumers. Apple Pay is not nearly as in use as WeChat pay or Alipay in China. Everyone is using mobile payments. It’s pervasive.

The BAT have the best of both worlds. These three companies have scaled up in their protected home markets with little overseas competition, tapped the Western capital markets with IPOs, and used the money to bulk up with billion-dollar acquisitions and chunks of the most promising, innovative tech companies, in effect paying a large tuition to gain knowledge on what makes Silicon Valley tick. They are innovating in ways that are tuned to China’s fast-paced digital culture and slowly filtering into the West. Their sprawling size and take-all competitive thrust has major implications for the US tech industry and for US consumers. Apple Pay is not nearly as in use as WeChat pay or Alipay in China. Everyone is using mobile payments. It’s pervasive.

Baidu, Alibaba, and Tencent are upending a long-held and cherished assumption that Silicon Valley companies will dominate the global tech economy in the coming decades. They are leading a high-tech gold rush guided by five key trailblazing strategies:

• snapping up cutting-edge technology startups

• keeping the innovation engines humming day and night

• expanding to high-potential tech hubs around the world

• advancing into artificial intelligence, big data, telemedicine, autonomous driving, facial recognition, mobile payments and lending, and digital entertainment

• constructing moats of many tech sectors in sprawling ecosystems to bulk up and ward off competitive invaders

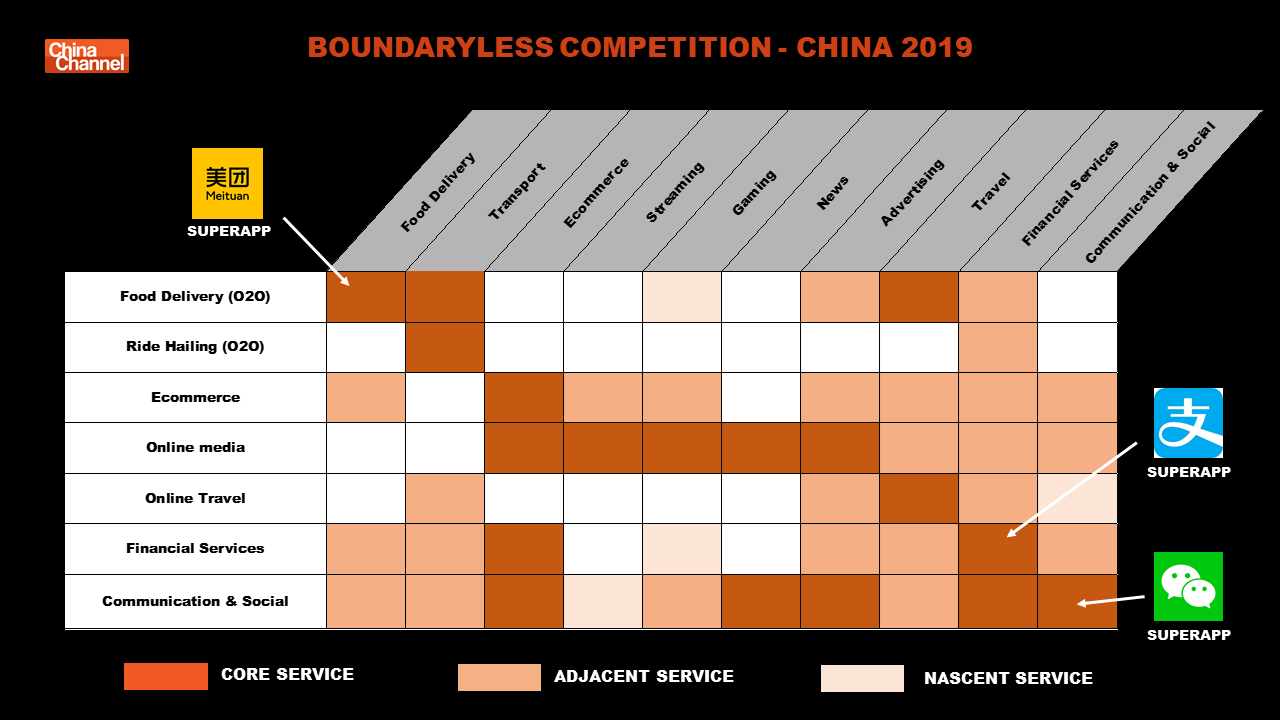

THE RISE OF SUPERAPPS: An idea now filtering into the West is China’s so-called “super apps.” They represent a different model of app design from those created in Silicon Valley. China’s multi-functional app Meituan, for example, combines services that resemble Yelp, Booking.com, GrubHub, Uber Eats, Kayak, Fandango and OpenTable in one Swiss Army-like array of services. This Chinese advanced app model contrasts with the common Western method of siloing apps for each service. But it lets the super apps capture and retain users within an umbrella and scale more quickly.

The most well-known of China’s super apps is WeChat, with 1 billion users and functions that mix elements reminiscent of Facebook, Twitter, Skype, WhatsApp, Instagram and Amazon. WeChat has shown its innovation stripes by evolving from messaging into an all-in-one superapp for e-commerce and payments, a trend in China tech with all titans racing to package in the most services. Created by Chinese tech giant Tencent, WeChat has evolved from text messaging into an all-in-one stool for mobile commerce  and payments. Facebook appears finally to be catching on, copying WeChat’s messaging feature of private exchanges within groups, and also getting into payments with its proposed cryptocurrency, Libra.

and payments. Facebook appears finally to be catching on, copying WeChat’s messaging feature of private exchanges within groups, and also getting into payments with its proposed cryptocurrency, Libra.

WeChat is getting good traction through its innovative new mini-programs, which bundle in shopping, gaming, and lifestyle services—and puts Tencent directly in Alibaba e-commerce turf. WeChat mini-programs reached the 1 million mark-half the size of the Apple App Storel5—and 200 million daily users in less than two years of introduction in January 2017. The mini-shops across 200 service sectors blend content, ad units, and commerce seamlessly with links to sales products that can only be accessed within WeChat. It’s a new concept from China, a monetization source that has originated in China’s vast mobile universe.

According to Hans Tung, managing partner at GGV Capital – “Chinese apps are more advanced in content, social networking, and commerce. “The rise of ‘super apps, such as WeChat, Meituan, Ele.me, and Didi, have spawned a different model of app design versus Silicon Valley. China is showing the rest of the developing world that there is a different, and arguably better-suited, approach to scale locally: by becoming an ecosystem that can bundle different functions in one ‘super app’ for their users.” “WeChat is becoming a default operating system and is fueling another wave of growth. Apps are being built on top of WeChat now.”

AMBITIONS OF AN EMERGING GLOBAL TECH SUPERPOWER – ENCIRCLE THE WORLD

BAT CEOs Robin Li of Baidu, Jack Ma of Alibaba, and Tencent’s Ma Huateng (known as Pony Ma) personify superheroes in the first generation of entrepreneurs since China’s Cultural Revolution of the 1960s and 1970s near destroyed the economy, and the later reforms of former leader Deng Xiaoping opened China to a socialist market economy and made glorious to get rich. All three founders cranked up their startups soon after the dotcom bubble burst about two decades ago.

What’s Propelling China Full Speed Ahead Towards Global Tech Leadership?

China’s Soviet-style thirteenth five-year plan for 2016-2020 to boost economic development by accelerating indigenous innovation, mass entrepreneurship, research and development, and patents to burst open as an innovation nation by 2020 and a technological and scientific world powerhouse by 2050-timed to the 100th anniversary of the Communist Party of China. A state-led blueprint, “Made in China 2025,” to close the gap in technology leadership by building national firms into globally competitive tech champions and gaining technological leadership in emerging sectors including robotics, new-energy vehicles, biotech, power equipment, aerospace, and next-generation information technology—all to achieve supremacy.

The nation’s “Internet Plus” plan to build up China’s companies as world-class competitors in mobile internet, big data, cloud computing, and Internet of Things. The proposal’s focus on optimizing health care, manufacturing, and finance by leveraging internet connectivity and big data.

MASSIVE INFRASTRUCTURE SPENDING

The nation’s Internet Plus” plan to build up Chinese companies as world class competitors in mobile internet, big data, cloud computing and internet of things. The proposals focus on optimizing health care, manufacturing and finance by leveraging internet connectivity and big data. President Xi Jinping’s Belt and Road initiative is to build a twenty-first-century Silk Road land and maritime and maritime trade corridor and next-generation information supremacy. A corridor that could outdo Americas posawar reconstruction Marshall Plan to foster economic integration with neighboring countries, boost demand for Chinese productions,and develop China’s poorer western provinces.

China’s race to be the global leader in upcoming fifth-generation (56) wireless mobile communications is one of the key battlegrounds. This new breakthrough will turbocharge connections and hyperconnect data from smartphones, laptops, refrigerators, dog collars, medical devices, and vehicles–and transform how homes, cities, hospitals, vehicles, and factories operate. Racing to get a first-mover advantage, China has outspent the United States on wireless infrastructure and cell sites by approximately $24 billion since 2015 and plans to invest more than $400 billion in 5G testing and development over the next 10 years.”

A state-led $15 billion China New Era Technology Fund to invest in startups and cutting-edge technologies and an acquire expertise from abroad when indigenous development is not possible.

GROWING VENTURE CAPITAL CLOUT

China’s venture capital market that already equals Sand Hill Road in size and impact, and measures up with mega financings, and growing share of unicorns financed startups globally. Chinese digital content app ByteDance ranks ranks first as the world’s most valuable privately held startup. Tencent’s and Alibaba’s rank in the top ten public

companies for market valuation began in the same league.

From 2010 to 2018, Chinese deal makers made 1.315 tech investments globally, investing $99.8 billion, with a considerable chunk in the United States in 2019. From 2010 to 2018, Chinese deal makers made 1,315 tech investments globally, investing $99.8 billion, with a considerable chunk in the United States.

China’s gains in national R&D spending to $409 billion, catching up to the United States at $497 billion,7 and predicted by the National Science Board to soon surpass the United States. Huawei’s fifth-placed spot worldwide in R&D investment, ahead of Intel and Apple.

GROWING ACADEMIC CLOUT

China is on the same level as the U.S. now for national R&D spending. And it’s about on par as well with scientific academic papers. China’s gains in national R&D spending to $409 billion, catching up to the United States at $497 billion,7 and predicted by the National Science Board to soon surpass the United States.

• China’s climb in patent applications—from seventh place globally a decade ago to second today. China has 21% of the world’s patent application patent filings. And the U.S. has 22%. China is predicted to surpass the United States for patent filings within two years, if current trends continue. Huawei’s lead, by far, as the world’s top filer for new patents. China’s rank as second worldwide for patents in use—29 % of a total 13.7 million patents compared to 40 % for the United States.

• China’s 4.7 million graduates in science, technology, engineering, and math, outnumbering 568,000 for the United States, and predictions that China’s STEM graduates will rise 300 % by 2030.

• China’s new lead over the United States in academic scientific research papers to 18.6 % of the world’s science

BUILDING STRENGTHS IN STRATEGIC SECTORS

China’s startups and tech titans alike are distinctly focused on the most progressive ideas in the digital world today and are challenging the United States in several sectors, with China-for-China innovations and business models. China gained an advantage by being able to leapfrog some older, western technologies and go straight to new tech such as QR codes, to electric vehicles, to high-speed trains, to mobile commerce, mobile entertainment and mobile payments, and superapps that combine all these functions.

Isolated from American competition thanks to the government ban on Google Facebook and Twitter, as we by Amazon, eBay, Yahoo, MySpace, and others to crack the Chinese market in the face of government restrictions and support of homegrown, internet warriors, China’s tech titans have logged in able double-digit growth rates for several years and continue to accelerate.

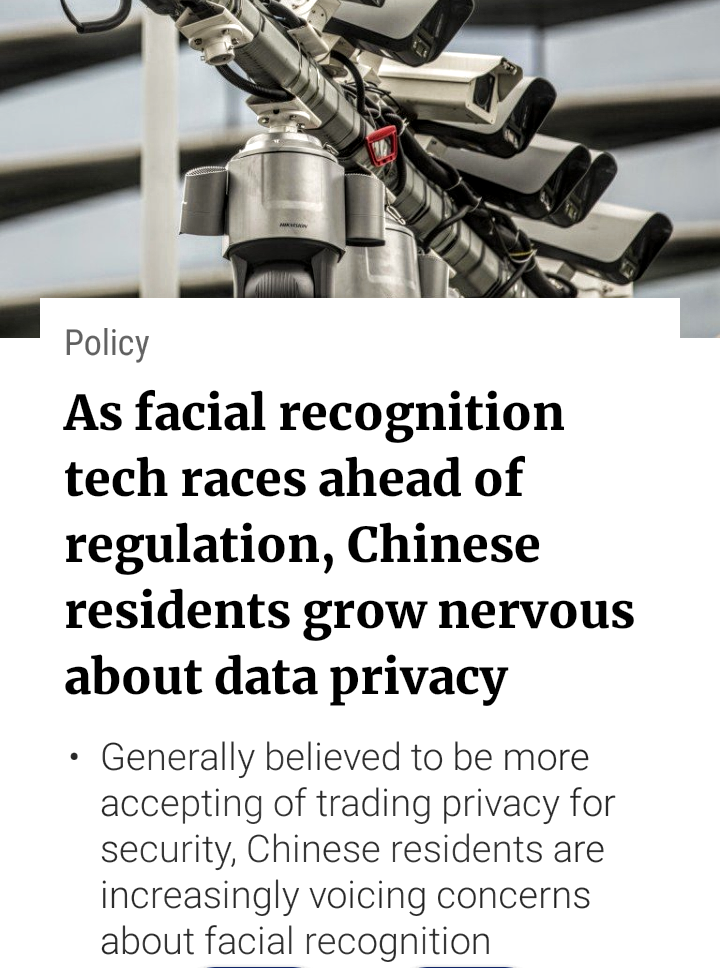

With the roll-out of 5G telecommunications and the advancement of artificial intelligence, China could also have an advantage over the West. Fewer privacy concerns and huge data sets have helped China gain in AI. With 5G, what has helped China is government spending and directives to push China forward. Huawei is the only player in 5G that both makes 5G-enabled smartphones and 5G telecom equipment. The Chinese telecom giant could be the first to enter into developing markets with this 5G package.

We are entering a new era of tech where separate universes are being created. This is caused by China’s fast rise, and a growing gap between the U.S. and China on technology innovations that matter for the future.

ARTIFICIAL INTELLIGENCE: Baidu has emerged as a leader in Al with driver-less-car technology and Al voice-activated smart-home devices. The United States has the technical lead, but China has the ability to innovate faster, given large data sets.

MOBILE PAYMENTS: China today is a cashless society. China’s mobile payments market led by WeChat Pay and Alipay already exceeds US credit and debit card usage. FINTECH: Alibaba affiliate Ant Financial is a one-stop financial services giant that uses big data and machine learning to dominate in money market funds, lending, insurance, mobile payments, wealth management, and blockchain services. Alibaba and JD.com have pioneered cashless and cashier-free stores and are digitalizing China’s retailing and logistics with efficiencies in merchandising, pricing, and marketing.

SOCIAL CREDIT: China’s new, controversial social credit system judges a citizen’s trustworthiness through technological surveillance and encourages compliance by giving ratings that can determine access to loans, jobs, schools, and travel.

SHARING ECONOMY: China-invented business models for shared bikes, battery chargers, umbrellas, basketballs, and takeout kitchens have been popularized by dozens of startups.

LIVESTREAMING: Video streaming sites from Baidu’s Netflixlike iQiyi and digital entertainment innovator YY are booming and creating online celebrities paid in virtual gifts by addicted viewers.

VIRTUAL REALITY: Arcades across Chinese cities are crowded like US amusement parks and offer VR escapes for about the price of a movie ticket.

ELECTRIC VEHICLES: Makers NIO and Xpeng Motors of fullfeatured and well-funded Chinese electric cars with selfdriving capabilities and built-in entertainment apps are being propped up by government subsidies to promote clean energy driving and push China to be the Detroit of electric vehicles.

According to Kai-fu Lee, government support for AI began with the Chinese president’s support for mass innovation and entrepreneurship, which led to a lot of innovation zones and incubators around the country. This also led to a flow of money into government-backed venture capital funds. Chinese state capitalism is 100 % behind winning in AI. One expects to see this play out in a lot of ways such as in education, loans, tax credits, government contracts, etc. It is China’s “moon shot” program.

AI is no longer about elite cutting-edge AI researchers making big breakthroughs (which the USA is better at). It is more about taking existing discoveries and implementing them in companies and industries. He cites several key factors that matter in this implementation – such as having lots of AI engineers, a robust entrepreneurial culture and favorable government policies. (We have covered the directive in a prior review of Amy Webb’s insightful book THE BIG NINE. She has pointed to the Chinese companies focused strategy of sucking up the world’s limited supply of AI engineers and researchers with lucrative employment and funding offers.)

China has a huge supply of quality training data-sets, and that is what will matter most in AI. We have covered this in is our prior review of Amy Webb’s book, as well.

AI SUPERPOWERS: According to Kai-fu Lee, the big AI giants (Google, Amazon, Facebook, Alibaba, Tencent, and Baidu) are mostly focusing on creating “AI grids.” These will be similar to electricity grids in that everyone will get access to general and likely commoditized AI capabilities. Machine learning will be a standardized service that any company can purchase. “These platforms—Google Alibaba, and Amazon—act as the utility companies, managing the grid and collecting the fees, while startups are focused on creating “AI batteries.” “Instead of waiting for this grid to take shape, startups are building highly specific ‘battery-powered’ AI products for each use case.” These companies are focused on depth and domain-specialization: think medical diagnosis, mortgage lending, and autonomous drones.

China is moving from an age of discovery to one of implementation in AI, and it is better positioned to win in implementation. China has an advantage in availability of quality curated training data-sets. He also cites several key factors that matter in this implementation – such as having lots of AI engineers, a robust entrepreneurial culture and favorable government policies.

THE SOCIAL CREDIT SYSTEM – A CASE STUDY: China’s new, controversial social credit system judges a citizen’s trustworthiness through technological surveillance and encourages compliance by giving ratings that can determine access to loans, jobs, schools, and travel.

Starting 2020, China’s social credit system of scoring Chinese citizens on a code of personal conduct is moving to foreign corporations. China is requiring that businesses collect and feed internal information into a centralized data system. The data will be used to quantify the moral codes of corporations, and the individuals that run them, and reward or punish accordingly. The rules first went into effect in 2018 but compliance was not enforced. Compliance will now be enforced by China’s Ministry of Public Security over access to corporate data housed on Chinese servers. Foreign companies are being advised to reevaluate their data collection processes in light of this new action. The impact could be a further decoupling of US-China tech and trade activities.

The new cybersecurity laws give the Chinese government access to files, contracts, copyrights, business strategies and phone records with no permission asked, according to Jacobson. The rules first went into effect in 2018 but compliance was not enforced.

A LOOK AT THE NEW TECH TITANS

TIK TOK: In just two years, TikTok has emerged to rival companies like Netflix, YouTube, Snapchat, and Facebook with more than one billion downloads in 150 markets worldwide and 75 languages. Since little translation is required, TikTok reaches well beyond other successful Chinese apps such as Tencent’s messaging app WeChat, which is ubiquitous in China but mostly used elsewhere among Chinese communities keeping in touch with people back home.

Chinese entrepreneurs such as ByteDance founder Zhang Yiming are showing that they can succeed in an openly competitive market internationally rather than only in China where the Great Firewall regulates the internet and blocks access to several U.S. social media sites.

where the Great Firewall regulates the internet and blocks access to several U.S. social media sites.

In August 2012, five months after founding ByteDance, Zhang launched his first mobile app, Toutiao or Today’s Headlines, an AI-powered daily curated feed of news content personalized to users. In 2016, Zhang added to his product lineup by introducing a video sharing app, Douyin, for the Chinese market. He rolled out an overseas equivalent of the Douyin video app, dubbed TikTok, in 2017. That same year, ByteDance paid an estimated $900 million to acquire Musical.ly, a social video app based in Shanghai with more than 200 million users worldwide and a large following in the U.S. The deal combined TikTok’s AI‑fed streams and monetization track record with Musical.ly’s product innovation and grasp of users’ needs and tastes in the West.

After ByteDance folded the four-year-old Musical.ly into TikTok, and rebranded it to a single application under the TikTok name in August 2018, the combined app immediately gained some 30 million new users within three months. The app makes money through ads and from the sale of virtual goods such as emojis and stickers to fans. An easy-to-use interface combining click-baity news and entertainment with powerful AI to precisely match users rather than recommend content based on their viewing habits and “likes” have fueled the app’s success. The homegrown content has become prevalent, particularly among rural and poorer residents in China, India, and other emerging markets where access to other digital entertainment options has been limited.

Chinese tech startups like TikTok and its parent company ByteDance have increasingly gone global. The 15-second music video app that TikTok has created and popularized is a good example of the type of innovation that is arising from China today, no longer copying American brands but inventing its own with apps for a new generation. TikTok beat both Tencent and Facebook to the idea.

a good example of the type of innovation that is arising from China today, no longer copying American brands but inventing its own with apps for a new generation. TikTok beat both Tencent and Facebook to the idea.

Facebook faces a serious global rival from China in TikTok. In 2018, TikTok ranked fourth worldwide as the top non-game app downloaded, at 663 million behind only Facebook at 711 million and its related apps WhatsApp and Messenger, SensorTower data shows. TikTok’s inroads in India and its young, mobile-savvy population is a big reason it’s soaring. About one-quarter of TikTok’s downloads come from India. TikTok added 188 million downloads in the first quarter of 2019, surpassing Facebook at 176 million, but trailing WhatsApp at 224 million and Messenger at 209 million.Facebook has since come out with its own 15-second video app, Lasso, and Google may be next. Facebook imitated Tiktok, the 15-second video app, by introducing a look-alike, Lasso. Facebook also borrowed some ideas from WeChat’s messaging app when the U.S. social media giant introduced group chats and private messaging.

ByteDance has been moving up in recent years with content deals and smart acquisitions, fulfilling founder Zhang’s mission of making his startup borderless. That goal post got a lot closer when, in November 017, ByteDance paid about $900 million to acquire Musical.ly, a social ideo app based in Shanghai with more than 200 million users world

de. The deal combined TikTok’s Al-fed streams and monetization track record with Mu

Bytedance’s share of digital media ad spend in the local China market grew from 5% to 23% over the past 2.5 years. A significant shift has taken place in China digital. They are looking to build out their wider ecosystem of services and where they chose to place their bets. ByteDance chooses the conventional way to monetize, e-commerce, by allowing people to sell goods on its platforms. Despite the advantage in user acquisition, as such a late mover it’s a real challenge to make meaningful inroads into mature categories like gaming, music or enterprise productivity.

XIOAHONGSHU: Social commerce or shopping intertwined with social media and entertainment is another made-in-China business model innovation. Shanghai-based  cosmetics and fashion shopping app, Xiaohongshu or Little Red Book, lets regular customers and key opinion leaders post reviews and share shopping experiences, hobbies and lifestyles. It commands 200 million users. Kim Kardashian has used it to share her makeup tips and promote her KKW Beauty Line to fans in the large China market. Little Red Book’s usefulness for American celebrities pushing products is one of many growing signs that China’s increasingly sophisticated digital universe is helping define the future of tech-based business.

cosmetics and fashion shopping app, Xiaohongshu or Little Red Book, lets regular customers and key opinion leaders post reviews and share shopping experiences, hobbies and lifestyles. It commands 200 million users. Kim Kardashian has used it to share her makeup tips and promote her KKW Beauty Line to fans in the large China market. Little Red Book’s usefulness for American celebrities pushing products is one of many growing signs that China’s increasingly sophisticated digital universe is helping define the future of tech-based business.

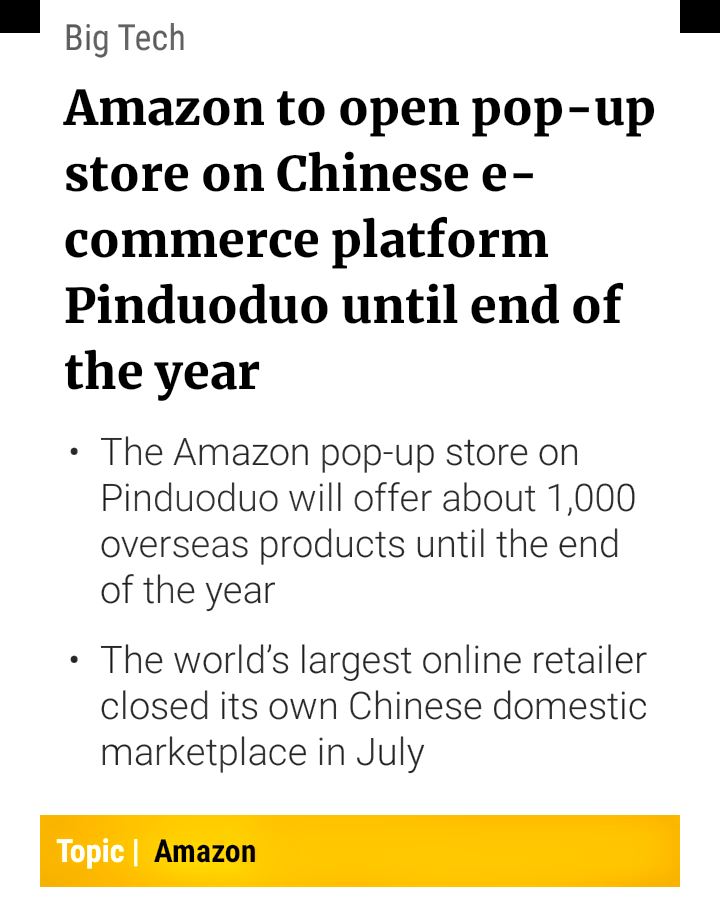

PINDUODUO: One must wonder why Amazon hasn’t copied a social commerce model that was invented by Chinese upstart, Pinduoduo. it’s a  gamified, group-purchasing bargain-hunting site founded by an ex-Googler four years ago, with 336m active monthly users and a $40b market-cap, exceeeding eBay. The model combines online shopping, social media, and discounts. Pinduoduo’s core users are people in rural China, or recent arrivals to cities, who are looking for bargains, rather than status, from their purchases. The best bargains are to be had from “team buying” exercises that require customers to use services like Wechat to find other buyers to club together with them to attain very deep discounts. The company is not profitable despite massive sales, and diverts nearly all its income to aggressive sales and marketing pitches.

gamified, group-purchasing bargain-hunting site founded by an ex-Googler four years ago, with 336m active monthly users and a $40b market-cap, exceeeding eBay. The model combines online shopping, social media, and discounts. Pinduoduo’s core users are people in rural China, or recent arrivals to cities, who are looking for bargains, rather than status, from their purchases. The best bargains are to be had from “team buying” exercises that require customers to use services like Wechat to find other buyers to club together with them to attain very deep discounts. The company is not profitable despite massive sales, and diverts nearly all its income to aggressive sales and marketing pitches.

TOUTIAO: AI-centric companies like Toutiao are taking such data network effects beyond just recommendations and curation. Toutiao is a news aggregator where AI can also create and police content. The AI is the curator but it can also be the reporter and editor, which means we may soon have AI that writes articles based on what it thinks you want to read. This results in more complicated data network effects.

also create and police content. The AI is the curator but it can also be the reporter and editor, which means we may soon have AI that writes articles based on what it thinks you want to read. This results in more complicated data network effects.

Toutiao is outpacing traditional news portals in volume. Its content technology sorts and tags more than 200,000 articles and videos daily and personalizes news feeds based on analysis of data obtained through the users’ locations, phone model, and click history. Users open the app and access news through Toutiao’s 4,000 media partnerships without following other accounts, unlike Facebook or Twitter. Toutiao uses machine- and deep-learning algorithms to serve up personalized, high-quality content without any user inputs, social graphs, or product purchase history to rely on.

MEITUAN: Meituan is a one-stop superapp that rolls in Uber Eats, Kayak, Yelp, and Groupon in a range of services including food delivery, travel bookings, and movie tickets.  Meituan packs in more than 200 service and product categories. The app has racked up 400 million active buyers, 5.8 million merchants in 2,800 Chinese cities, 6.7 billion transactions, and 5 billion user reviews.

Meituan packs in more than 200 service and product categories. The app has racked up 400 million active buyers, 5.8 million merchants in 2,800 Chinese cities, 6.7 billion transactions, and 5 billion user reviews.

Food delivery service market that has sprung up in China with urbanization, technology development, widespread mobile internet usage, and increased consumer spending. The consumer economy in China will account for about half of the country’s GDP growth by 2020;23 the e-commerce market will hit $1.8 trillion by 2022, up from $1.1 trillion in 2018.24 Meanwhile, the food services segment of the e-commerce market is growing by nearly 20 percent yearly and could top $1.15 billion by 2023.

Meituan is relying on big data and AI innovations. A patented dispatching technology analyzes big data to find the shortest routes and nearest couriers and to avoid traffic jams and accident sites. An intelligent voice assistant lets couriers receive and report orders when delivering without having to operate their mobile phones while riding. Such advances have helped Meituan to shave seven minutes off its average delivery times since 2016

Other techie stuff Meituan has built in are security checks that identify and verify riders by QR code and an advanced electronic record management system to confirm business licenses of merchants on its platform by connecting with a government supervision database. The system also can synchronize data to track food safety and hygiene and check and analyze customer reviews by time period, location, and product category to spot any trouble.

THE IMPACT OF TRADE TARIFFS. CHINA’S OWN INTERNAL RISKS TO GROWTH

- American supplies because of national seu dents have firmed up China’s resolve to cut reliance on US tech-smarts to fill gaps and to grow its own core pe and to grow its own core technologies, but it will take years and wont be so easily done.

A host of issues could put the brakes on what fuels Chinese startups curbs on China venture capital in US tech startups and a her bar for Chinese companies to go public in the United States and use that capital to scale up in China. Nasdaq senior vice president Bob McCooey predicts a slight slowdown in the number of Chinese companies listing in the U.S. this year. He expects the year 2019 to wind up with 35 to 38 Chinese IPOs in New York as compared to the projected 40. Investors are worried about the underlying China-U.S. pressures, which is creating uncertainty and lower valuations.

A host of issues could put the brakes on what fuels Chinese startups curbs on China venture capital in US tech startups and a her bar for Chinese companies to go public in the United States and use that capital to scale up in China. Nasdaq senior vice president Bob McCooey predicts a slight slowdown in the number of Chinese companies listing in the U.S. this year. He expects the year 2019 to wind up with 35 to 38 Chinese IPOs in New York as compared to the projected 40. Investors are worried about the underlying China-U.S. pressures, which is creating uncertainty and lower valuations.

In the “what could go wrong” list of deterrents that could slow China’s tech boom, the blacklisting of three leading Chinese startups in artificial intelligence certainly stands out now. The Trump Administration has put these three AI companies–SenseTime, Megvii and iFlyTek–on its entity list, requiring American companies to get approval before selling to them.

Geopolitical issues loom large. Nationalization or breakups of China’s tech titans. Military conflicts over pending trouble spots China Sea and China’s claim to Taiwan, room mented state-backed reforms on a local level. Growing criticism over China-styled colonialism, such as using loans to gain control over strategic locations, notably the Sri Lanka port and surrounding land.

It’s conceivable that China could roll back the capitalistic reforms ushered in by Chinese leader Deng Xiaoping in the late 1970s to return to Chairman Mao’s drab communism of several decades ago.

Among other things underpinning China’s threat to the tech economy gains are a whole host of socioeconomic issues and cultural issues that could deter China from what it considers its rightful place as a world-leading economic power. Educational reforms – Teaching that has prioritized memorization and test taking in China instead of creative thinking. An aging society and declining workforce after decades of explosive growth.