An Array Of Thoughts Around Trends, Technologies And Economic Advances In The Industrial Internet Of Things.

INDUSTRIAL IoT’s MONETIZABLE VALUE: A Look Through The Fog

Parts of this article were inspired from our research series about industrial IoT’s monetizable value creation. ArcInsight Partners, a research & strategy advisory firm focuses on Industrial IoT, enterprise digital transformation & smart city evolutionary strategies. The author Praas Chaudhuri (co-founder & principal analyst) worked with business strategy consulting firms, and has also advised many early-stage ventures. He is also an engineer with a background in industrial process-control.

Arcinsight Partners Appreciates Your Ongoing Analyst-Briefings, Thoughts And Sharing Use-Cases/Applications With Us.

MARKET EXPECTATIONS ARE SHIFTING

IoT has finally fallen off the hype-cycle peak. The honeymoon phase for IoT is winding down. The media noise is beginning to quieten down. Assorted cheerleaders that amplified the hype on social media, at meetups and global conferences have moved on in search for new bandwagons. The golden age for industrial IoT is finally arriving.

If 2015 was about building up initial hype for industrial IoT, 2016 was about pinning down a chain of infrastructure, technology components & partnerships required for building industrial IoT applications effectively. That activity continues for many. But Its 2017 Now. The market expects players to move beyond ppt slides & PR claims to focus on real business value discussions. Use-cases showcased through mock-ups, demos, pilots and test-beds are so “2016”.

2017 is for starting serious conversations about deployments at scale. Its time to settle-in for the long haul and focus on monetizable value creation. Its time to weed out market players living off IoT hype, and focus on growing those that developed unique insights into operational domains and then leveraged analytics to solve real problems of industry. Its Time For Rubber To Meet The Road.

“Connectivity and data storage are old news,” says Rob McGreevy, vice president of operations, asset and information management at Schneider Electric Software. “The ability to connect to more things more cheaply is necessary, but not sufficient. What’s interesting are the applications this makes possible. Innovation is in the (problem solving) applications, not the platform.”

THE “M2-R2 TEST” FOR IIoT. OR, WHAT WOULD DIGITAL DO ?

To appreciate the massive gap that exists today between economic benefits projected for industrial IoT through 2025 (and beyond), and what has been captured so far through enterprise-scale deployments, one must sharpen focus on value creation in every enterprise IIoT project. Do enterprises have processes and skill in place to allow tracking of value in clear financial measures?. For larger deployments with prospects for multi-year value generation, the M2-R2 Test becomes even more critical.

- Is It “MEASURABLE”: The next step now is to look into the other end of the pipe and confirm those promised benefits are really flowing through. Here are a few questions that must arise in our collective heads.

- Metrics – How do we measure IIoT value-creation? What are the appropriate operational metrics?

- Process – Which key enterprise processes underwent transformations by IoT ?

2. Is It “MATERIAL”: To borrow an accountant’s term, value creation matters most when it has potential to move the needle. The scale of transformation is key for an enterprise that is large, and of the expected new value it must generate in order to effect a visible shift.

- Baselines & Acceptable Thresholds – What minimum level of value-creation is considered acceptable to move the economic needle? What should be considered baseline economic output for success ? What decision criteria must be institutionalized in order to green-light new projects?

- Risk Assessment – Expectations of new value creation must also be accompanied by an understanding of the risk being taken on by an enterprise to generate this value. Assessments of new value must be adjusted against similar assessments of downside risks to the enterprise should an IIoT initiative fail. (and a few must fail in order to generate new learning as well).

3. Is It “REPORTABLE”: At what point should one expect companies to stand up and report on IIoT value-creation to the marketplace and to the investor community, using conventional metrics?

- Financial Metrics: How many cents of EPS did GE’s Digital Business contribute last year towards earnings for GE’s entire business portfolio ?Did our digital initiatives improve EBITDA Margins for a business unit ? For the entire business portfolio ? What was the required incremental capex/opex investment ? Is there a clear visibility into free-cash flow attributed to digital initiatives ?. (Replace GE with Siemens, ABB, Honeywell, United Technologies, Caterpillar, Deere, Emerson, or your own company name).

- Operating Metrics: What was the improvement in recurring revenue ? How many points did account retention improve? How many points did customer acquisition-cost reduce ? What was the customer churn last quarter? What was the short-term revenue impact migrating customers away from a product-centric sales model ?

4. Is It “RECURRING”: One time adjustments or proforma projections to report on value are disreputable practices from the dot com era (though some still play with them). Some Wall Street analysts are more inquisitive since. Soon they may look for evidence of ongoing IoT value creation in quarterly guidances, and forecasting streams of incremental value over their projected life.

THE QUEST FOR NEW VALUE CREATION

Done right, industrial IoT changes a company’s structural foundation and its business model. The transformation better known today as “Servitization”, transitions the companies product to a “service” business model where it sells the utility of goods on an ongoing basis, rather than selling those goods outright.

The evolution from product provider with a ship-it-&-forget-about-it mindset to that of monitoring product activity and providing service on an ongoing 24×7 basis is a significant shift. The services element, warranties, service contracts, how you interact with the customer, and what you learn from these customer interactions that could be forwarded into predictive selling are areas that companies might need to rethink and realign in their business as more IoT analytics come online.

The evolution from product provider with a ship-it-&-forget-about-it mindset to that of monitoring product activity and providing service on an ongoing 24×7 basis is a significant shift. The services element, warranties, service contracts, how you interact with the customer, and what you learn from these customer interactions that could be forwarded into predictive selling are areas that companies might need to rethink and realign in their business as more IoT analytics come online.

“The Connected Industry opportunity is not incremental. Its about creating something that’s new or different. It will therefore come with a fair amount of uncertainty – also called RISK. (several business model transitions are inflight at IIoT- focused companies as we speak. We are watching them closely for early indicators of success, or tough learning experiences). This will, in turn, reduce the appetite for buy-in. Manage and embrace this uncertainty by developing a business model testing plan to both identify assumptions and uncertainties and then test the most sensitive assumptions. This will ensure your investment into this new opportunity is efficient and effective with a higher likelihood of a successful outcome.”

MAKING IIoT TRANSFORMATIONS WORK. AND STICK.

Rethink The Framework Of Doing Business:

This IIoT-driven transformation follows a complicated path, and involves many aspects of the enterprise to work in-synch as the business gradually changes direction. Its also a long term commitment to the new way of doing business, and may well test the limits of time continuity of a CEOs term. This requires board-level commitment.

- Enterprise skill sets: Entirely new competencies both in business and technology areas will be brought to bear in this new model,

- Management systems: Accounting norms, financial reporting, performance monitoring, CRM,

- Business practices: HR hiring, go-to market strategy formulation, sales & marketing, sales compensation, pipeline management, product management, customer-management, market-research techniques, field services, even your investor-relations with Wall St. analysts,

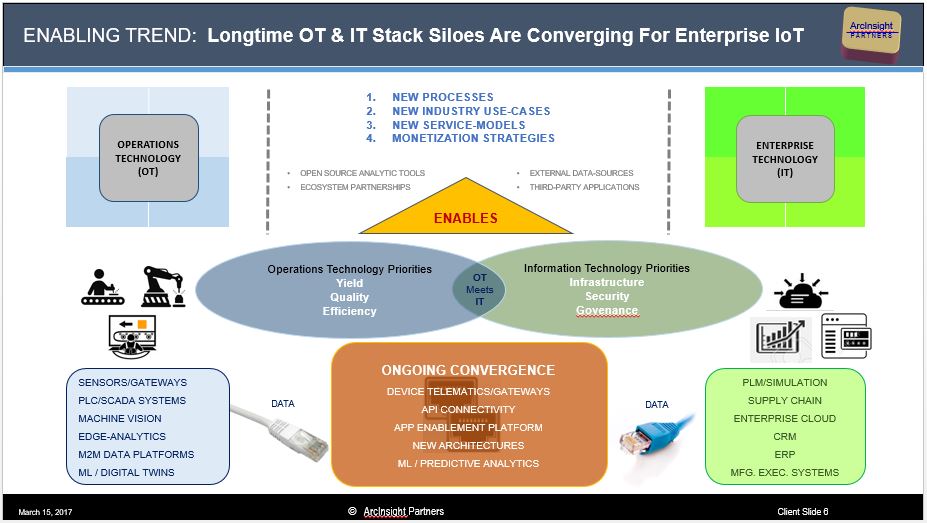

The Technology Infrastructure:

“Preparing the workforce for the needs of the Industrial Internet will place new demands on information technology and operations staff as well as the engineers who build machines.” Operations technology and Information Technology will increasingly be required to ride on a common transport to share data. While this is harder than it sounds, much progress has been made by makers of process control, data-acquisition and monitoring hardware/software to offer that convergence right out of the box. Not the least, is the need for a robust strategy to secure edge-devices, gateways, transport layer and even human interfaces. “With the Connected Industry, where there is a plethora of technology choices across the IoT technology stack, companies face questions around which technologies to select and how to bring them together. This can be daunting to the uninitiated, but exhilarating to those looking to build innovative, agile, lean business solutions. Ensuring you’re always business driven is essential – nothing has changed there – but how you deliver the outcome will probably change.”

and Information Technology will increasingly be required to ride on a common transport to share data. While this is harder than it sounds, much progress has been made by makers of process control, data-acquisition and monitoring hardware/software to offer that convergence right out of the box. Not the least, is the need for a robust strategy to secure edge-devices, gateways, transport layer and even human interfaces. “With the Connected Industry, where there is a plethora of technology choices across the IoT technology stack, companies face questions around which technologies to select and how to bring them together. This can be daunting to the uninitiated, but exhilarating to those looking to build innovative, agile, lean business solutions. Ensuring you’re always business driven is essential – nothing has changed there – but how you deliver the outcome will probably change.”

Look For Value Opportunities In The Data Ecosystem:

Too often companies focus too narrowly on the local problem at hand. While this generates a great local solution, often this does not translate into significant monetizable value for the enterprise. To uncover and define a real business problem may often require instrumenting the extended enterprise as well. In the process of framing an operational problem for predictive analytics, it helps to step back and look at the bigger ecosystem picture. “With a full awareness of your ecosystem and an understanding of its expected future capabilities, you’ll be asking yourself where to start. The best starting point would be where you can have the most immediate impact. A rapid, positive effect motivates the ecosystem, giving it confidence that the novel partnerships do work and a strong momentum to move forward.”

The Internal Collaboration Imperative:

The biggest challenge is building a critical pool of data-scientists (not easy to find enough) and a pool of industrial domain-experts who are expected to work joined-at-the-hip and bring their respective expertise to bear on industrial problem solving. Similar approaches to teamwork will be expected of sales & marketing teams with product designers, and with field-service teams. “It also will require that those groups collaborate in new ways.”

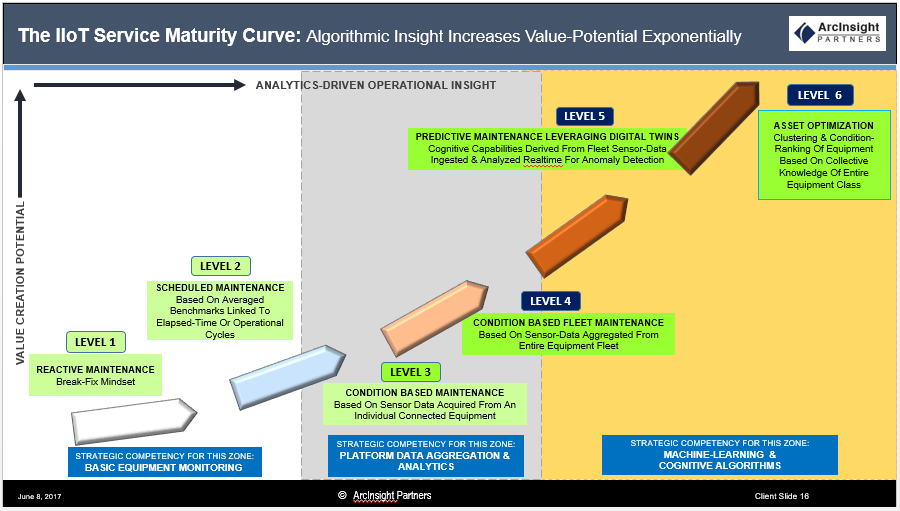

Transforming Operations Philosophy: Much has been written and talked about practices such as condition based maintenance, failure-prediction and cloud-based machine learning at the plant floor level.

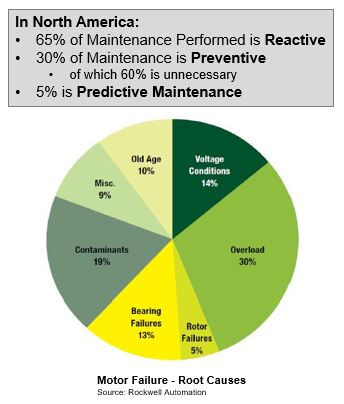

- Maintenance is evolving from breakdown-management to preventive maintenance, and evidence suggests will soon be poised to enter (but fully there yet) the realm of predictive maintenance in a big way.

- Failure-prediction involves assessing time-to-failure within acceptable bounds of prediction-accuracy. Such programs alert producers to the precursors of equipment failure days/weeks before a total failure occurs. This allows field maintenance programs to be scheduled with precision and efficiency.

- Machine-learning supported knowledge-management that is able to reach between different silos within an organization, aggregates disparate sets of operational data, from enterprise documents, maintenance records, user-manuals, and even structured data to generate valuable insights for safety, field-repairs and maintenance.

Predicting failure is only one part of the problem, identifying root-cause(s) is the other.

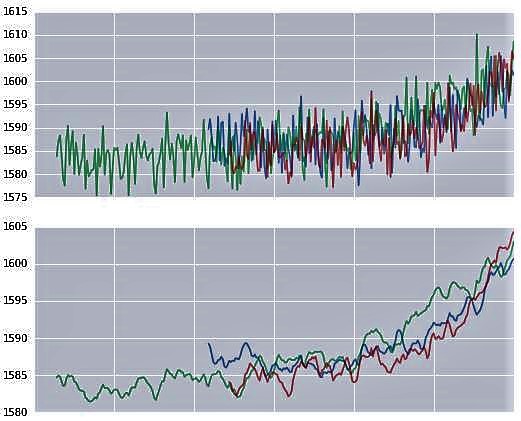

By bench-marking similar pieces of equipment or  comparable locations, manufacturers are pointed in the direction of inefficient deviations. While benefits implications are reasonably obvious at individual asset level, real value exists when an operator can monitor an entire fleet of geographically-distributed assets simply by observing a heat-map of machine health, and trigger shutdown/inspection decisions with a high degree of confidence. Additional value gets generated when the equipment manufacturer provides fleet-monitoring as a service to its client. The positive spiral accelerates when then they develop a deep-enough knowledge-base to take on health-monitoring for competitors equipment as well. We modeled this competency-evolution, and discovered significant opportunities for margin expansion.

comparable locations, manufacturers are pointed in the direction of inefficient deviations. While benefits implications are reasonably obvious at individual asset level, real value exists when an operator can monitor an entire fleet of geographically-distributed assets simply by observing a heat-map of machine health, and trigger shutdown/inspection decisions with a high degree of confidence. Additional value gets generated when the equipment manufacturer provides fleet-monitoring as a service to its client. The positive spiral accelerates when then they develop a deep-enough knowledge-base to take on health-monitoring for competitors equipment as well. We modeled this competency-evolution, and discovered significant opportunities for margin expansion.

EXPLODING A FEW MYTHS ABOUT IIoT

There is considerable hype in corporate marketing and PR accompanying the rise of industrial IoT. Some are natural accompaniment to a new technology wave that comes to town. More concerning however is a smokescreen it generates for companies lacking serious long term commitment (or those yet to solve a real industrial scale problem using IoT) to make tall claims. IIoT Is A Long-Gestation Game. Serious Players Must Be In It For The Long Haul. So let’s explode a few myths right off the bat.

“Platforms Make The IoT”:

IoT platforms range greatly in terms of features, but the common idea is to ingest and analyze data, then monitor, detect, and predict. These are valuable technology foundations upon which devices can be managed, applications developed and services created. However, most platforms don’t provide an all-encompassing solution and it is common for organizations to use more than one platform to get to desired results. It must also be acknowledged that the market for data-management platforms is terribly fragmented and undifferentiated. Nearly every equipment vendor calls itself a ‘platform providers’. At last count, nearly 400 offerings vied for mind-share, some small niche ones, others well entrenched big brand mainstream players. There is no single dominant platform as yet. The IoT data-management platform space is still witness to new launches of platforms. We have written about this in part-1 of our whitepaper series, about monetizable value creation in IIoT.

“Identifying A IoT Use-Case Equals Solving An Industrial Problem”:

At conference after international conference, one is treated to an impressive array of demos and mock-ups of industrial equipment with sensors hooked up to connectivity/storage/processing hardware that visualizes operating parameters on an equally eye-catching mobile application. These are cool ways to showcase difficult technology concepts. Ask for facts about a use-case at a real client deployment, and one often get’s blank stares. The same applies to impressive graphics, videos and animations on corporate websites. Perhaps adding problem narratives from a real client use-case may bring some credibility here. However, wide IIoT deployments at scale remain the best endorsement of a successful use-case application.

ArcInsight Partners invited a range of IIoT-related companies (hardware, software and integration-services players) to share their real client IIoT deployment experiences into a blind-pool for value-creation assessment using our analytic framework.

“Machine-Learning Can Predict Anything”:

In a conventional process plant, we are limited in our ability to add more sensors to an existing equipment. For users looking to know remaining life of an equipment, a viable approach (besides operator experience) is to build prediction models using machine learning algorithms on all available sensor data over a significant time period. The resultant model is tested repeatedly for prediction accuracy and fine-tuned. More detailed understanding leads to more authentic approaches to uncertainty, and identification and quantification of what were previously ‘unknown unknowns’. This helps establish greater confidence in predictions, more effective project planning, and more suitable financial arrangements. However, no machine learning prediction model is perfect. False positives do happen, and they have cost implications.“due to false positives of alarm triggers, equipment is opened, inspected and restarted. This pushes maintenance costs way up.” On the other hand, a failed notification trigger (a false negative) for a high pressure/high-energy pumps could have potentially catastrophic failures and safety consequences. Customers want significant predictive ability, advance notice of failure and no incidence of false positives (or negatives).

“We’re often not aware of our assumptions and the biases they have on our decision-making. Identifying your assumptions and uncertainties, and testing them, is critical to ensuring one doesn’t miss any opportunities for new insight and, secondly, aren’t influenced by the wrong data allowing us to make informed decisions.”

“Failure Prediction Is The Sole Objective For Analytics”:

Automating predicting failure is only one part of the problem, automating identification of root-cause(s) is the other more hairy part of problem-solving from an algorithmic standpoint. By bench-marking similar pieces of equipment or comparable locations, manufacturers are pointed in the direction of inefficient deviations.

“IIoT Alone Makes Remote Monitoring Possible”:

Valves and actuators in oil refining complexes may be half a mile away, and are impossible to monitor and manage, except remotely. Modern DCS providers such as Rockwell Automation and GE Automation enable single plant operators to look at hundreds of such devices and high value equipment (feed pumps, gas compressors, condensers & heat-exchangers, boilers, heaters & furnaces) mostly from a single panel. Hardware made by Opto 22 enable data-acquisition from legacy industrial sensors and devices to connect to networks in order to operationalize IoT. Application software such as PI Historian from OSIsoft manages and archives time-series data from industrial process control systems. It enables open data infrastructures to allow enterprises a comprehensive real-time plus historical view into operations, and transform operational data into actionable decisions and analytics. Such ecosystem players allow localized close-loop and plant-wide control systems to make autonomous decisions on a set of operating variables. They have logically programmed alarming & trip-systems to ensure operators are not overwhelmed with multiple alarms during anomalous process events. They also ensure production and equipment damage risks are minimized during a major anomaly. IIoT did not invent remote monitoring. That existed since years before that was even a buzzword. What it did was bring to market new communication standards and data-aggregation platforms that allowed this monitoring to happen over a much larger scale of operations. The economics thumb-rule here: To achieve a return on the investment, the benefit that accrues from the acquisition of data must exceed the cost incurred acquiring it.

“F.F.T. Is A Quintessential IIoT Tool” :

Another IIoT misconception. Use of the FFT as a problem solving technique predates IIoT by many years. Simply put, it is a mathematical function that transforms signals acquired in a time-domain into a frequency domain. This technique has use-case applicability today for any industrial asset that is monitored for vibrations. Companies such as Predikto & SparkCognition recognize this well. So do industrial equipment makers such as GE, Rockwell Automation and Flowserve. But clearly it applies only to a specific class of equipment with moving-parts (it is not a IIoT catch-all). Its value creation potential by predicting equipment failure is immense for industrial IoT. Here’s some real field facts. When correctly implemented, vibration analysis provides the following lead times to failure: (a) Main bearing, 18+ months; (b) Gearbox slow side, 9 to 12+ months; (c) Gearbox fast side, 6 to 9 months; (d) Generator, 6 to 9 months; When scheduling barges, maintenance vessels, and other parts and equipment for offshore installations it actually allows several months of advance planning time to find the days that best suit the operator from a production and weather-access standpoint.

“Predictive Maintenance Is Easy”:

In plain English there are only three way to manage equipment in the real world. (a) Wait until something fails; (b) Replace components at an intervals; and (c) Predict failures. Predictive maintenance is a hot topic because there is an immense cost-implication gap between practicing (a), (b) or leveraging (c). Companies such as thyssenkrupp elevators (Thyssenkrupp) have taken this capability to impressive heights in field-service and leveraged other partner tools in augmented reality to enhance this. Although predictive maintenance is a very new approach, there is interesting early data from offshore installations that validate this. “A single onshore event involving a crane is $300,000 on average for a 1.5-MW wind turbine. Avoiding the crane cost by predicting failure using a CMS (condition monitoring system) drops the per-event cost to $12,000 to $15,000. That is, a single event O&M cost avoidance or saving of $280,000. Offshore, this number jumps significantly per event.” As a rough O&M estimate, take these costs for repair and downtime and multiply by 11% annually. Then multiply the cost of this annual failure rate by the number of years out of warranty (typically 15 to 18 years) and it is easy to see where a reduction in this area would substantially increase profitability.

Edge-Computing & Control:

Plants have had computing power available locally well before “Edge” & “Fog” came into being. PLCs were localized close-loop control systems that made autonomous decisions on a small set of variables. They have logically programmed alarming & trip-system that ensure operators are not overwhelmed with multiple alarms during anomalous process events. Plant Historians have access to an immense range of an equipment’s operating life, enough to carry out most root cause analysis for individual assets. What edge-computing brings to the table iss the ability to process higher level decisions that involves complex correlations locally at field level, insights that previously required sending this data to base for human technicians to pore over. All things being equal, its really major contribution to value creation is the fact that it saves thousands of dollars in transport-bandwidth over costly LTE networks.

THE INDUSTRIAL IoT HAS MERELY JUST BEGUN.

Startups bringing digitization and IoT infrastructure to asset-heavy industries — such as manufacturing, logistics, mining, oil, utilities, and agriculture — are receiving a greater share of the deals going to the greater Internet of Things (IoT) ecosystem. Since 2014, IIoT’s share of investment deals has grown in every year. Industrial has gradually increased its share in overall IoT funding. It represented nearly 40% of all deals done and also absolute dollars raised through Q3’2016. We have barely scratched the opportunity surface in emerging industrial and new markets such as India. There is an interesting ecosystem of IoT-startups coming up in countries such India & Isreal and in the UK as well. These market maps, shared by Bharat Innovations Fund (an early stage IoT investment vehicle based in India), and Grove Ventures (a fund that looks at early stage investments in Isreal) illustrate the point.

There’s much to be excited about industrial IoT. One could argue the fun has just begun. IIoT’s falling off the Gartner’s hype-cycle peak is a wonderful thing for industry. It clears the stage for serious contenders to step-up and show their problem solving and applications building prowess.