SUBSCRIPTION BUSINESS STRATEGY: An Outcome Of IIoT-Driven Digital Transformation

FROM

Chunky Annual License Revenue

Passive One-Off Customer Relationship

One-Time Purchase

Capex Planning

Discrete Owned Manufacturing

Value Delivery Through Supply Side Aggregation

TO

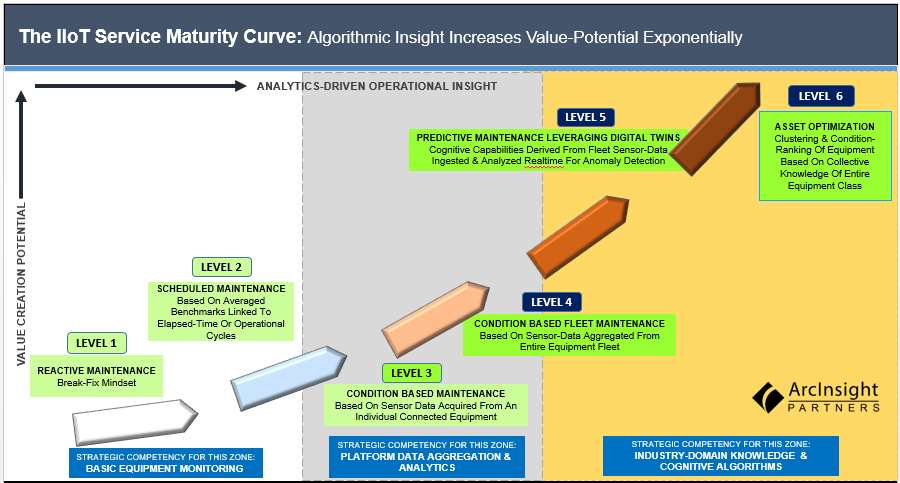

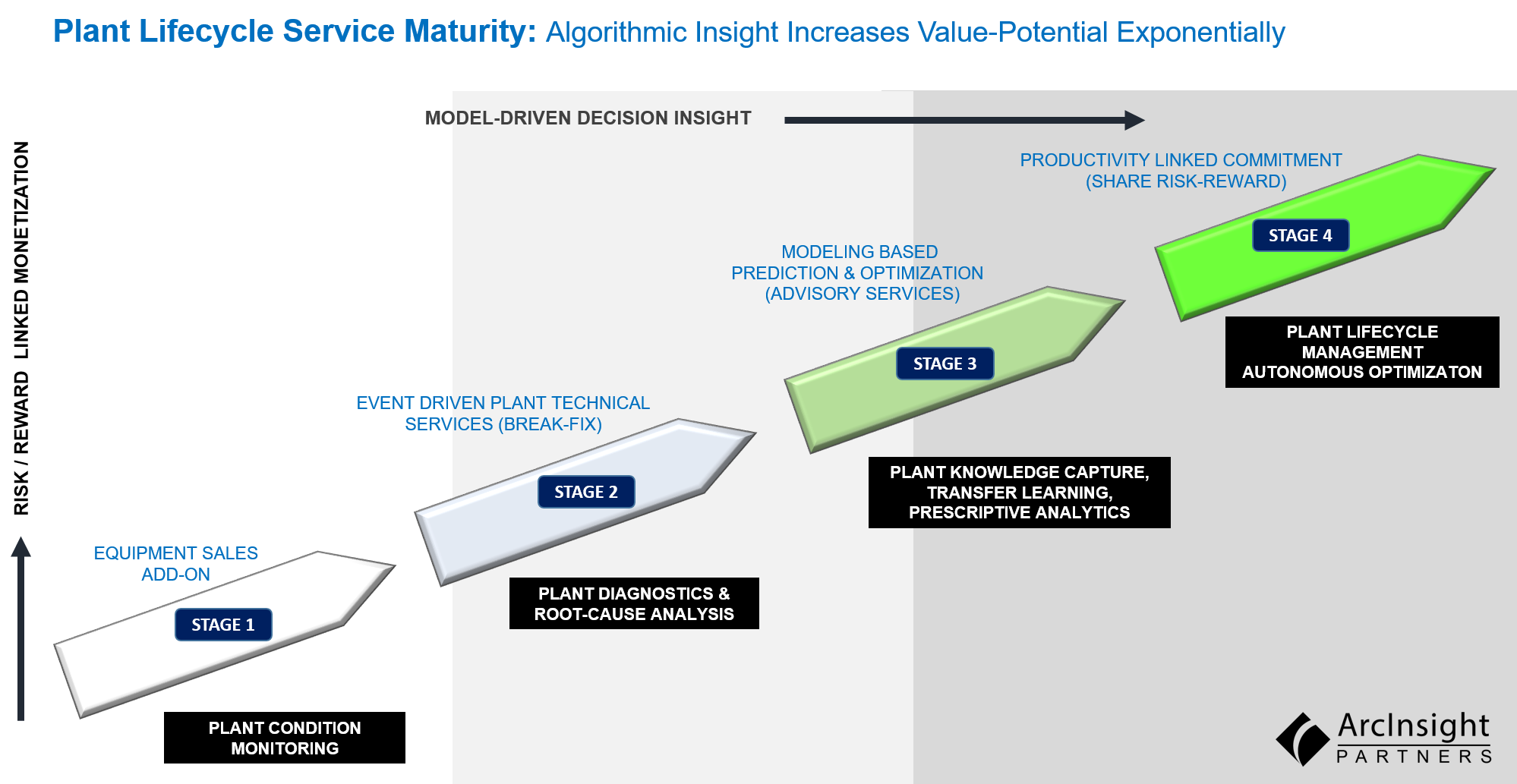

Recurring & Incremental Revenue

Ongoing Active Customer Interactions

Pay Per Use

Opex Planning

Integration Of Vendor Monitored-Networks

Demand Side Network Aggregation

Key Success Factors For Companies Leveraging A Subscription Model.

- Deliver value early and often to ensure customers continue to renew. Innovate faster. Create value more frequently.

- Greater commitment to successful value delivery through subscription offerings.

- Operate a platform with flexible options that allow customers to scale updown or, mix & match product options receive the most value products and services. Easier adoption and onboarding Paths. Ability to allow trials/pilot of new or different feature-options or product-options in a portfolio.

- Robust cloud infrastructure that allows customers to subscribe to services and make a case for IT systems modernization, demonstrating implementation and maintenance cost savings.

Transformations Don’t Happen Without Organizational Challenges

The process of transforming a company to subscriptions business model can be challenging, particularly for large traditional companies built for the fading licensing or product revenues model. Several issues to consider.

- Does taking revenues over time versus upfront, impact bottom lines.

- Subscriptions could impact margins in the short term. Important point to consider for a public company.

- Salespeople accustomed to selling annual perpetual licenses or maintenance contracts may struggle to adapt to a philosophy. The result could be a longer learning-curve to move to new incentive models, often attempts to protect an outdated business model.

Changes Are Coming For Companies Using Subscription Models

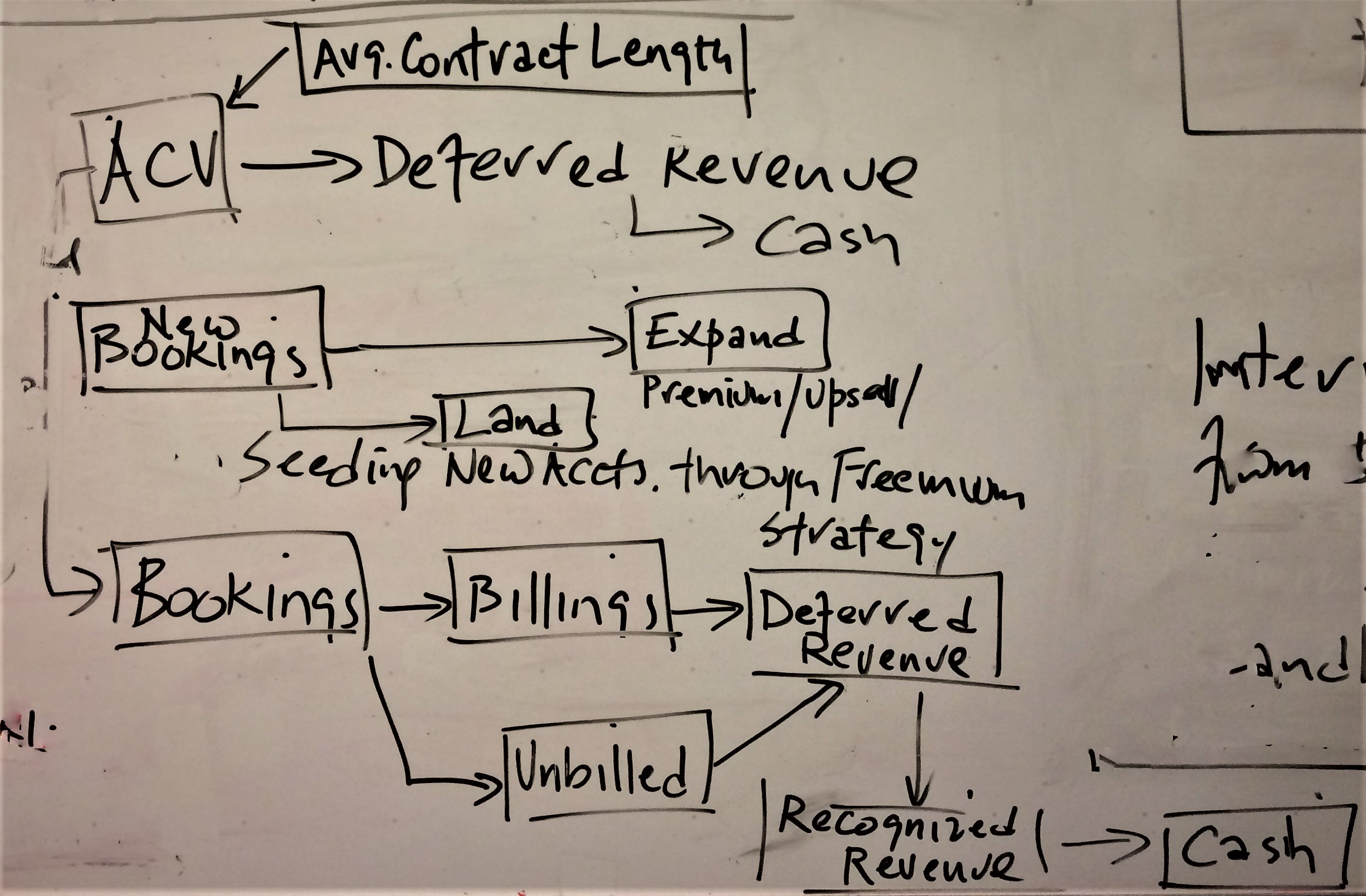

An update to generally accepted accounting principles (GAAP) for US companies is turning out to have particularly large consequences in parts of the tech industry, which is having to overhaul the way it reports revenues and costs. The new standard, known as Revenue from Contracts with Customers, is designed to narrow the distance between US GAAP rules and International Financial Reporting Standards (IFRS).

The software industry is set to be one of the most deeply affected. Operating under highly specific industry rules for when revenue can be recognised, and with many companies in the midst of a transition from upfront licence sales to a software subscription model, the move to an entirely new accounting regime will force complex changes.

Under so-called “ramp” deals, for instance, customers pay more in the later years of a contract. But under the new rules, the revenue recognition will have to be spread evenly over the period, resulting in more sales being reported earlier. And companies that sell both hardware and software — often accounting for each element separately — will have to treat them as a single sale if they are judged to be part of a single IT system.

Analysts and investors must be on the look out for idiosyncratic effects — and to make sure they do not mistake higher reported revenues for a real change in the underlying business.