Rethinking The Buyer-Seller Relationship Dynamics

A CHANGED ENVIRONMENT FOR BUSINESS

The auto industry has been brought to its knees by the scarcity of a tiny, and normally ubiquitous, piece of technology: the semiconductor. In 2021, automakers were obliged to cancel plans to build ten million cars. We forecast that they will cancel a further seven or eight million in 2022 and four million in 2023, as demand for semiconductors outstrips supply by 10 per cent. And what goes for automakers also goes for many industrial companies because they too rely on semiconductors in their products. As the U.S. government noted in its “Briefing Room” blog, the paucity of semiconductors has not only been affecting the automotive industry, it has also been “dragging down the U.S. economy” and “could cut nearly a percentage point from GDP growth.” (HBR, May 2022)

Amidst a business environment mired in supply uncertainties, clogged ports, persistent covid-induced lockdowns in China, skyrocketing shipping rates, low drought-induced water levels for inland shipping, the Ukraine war, trucker strikes, volatile crude and fuel oil markets, comes a timely book advocating a set of principles to transform business relationships with suppliers and to adopting a new perspective to the procurement function. Christian Schuh, Wolfgang Schnellbächer, Alenka Triplat, and Daniel Weise are partners at the Boston Consulting Group and the coauthors of Profit From the Source: Transforming Your Business by Putting Suppliers at the Core.

Add in a couple of new dimensions to the situation above. The margin pressures on traditional products and services due to diminishing technology differentiation among machinery & equipment players, as well as increasing cost competition from new emerging players taking advantage of global supply chains. Then consider the increased competitive pressure from new technology-enabled products and services supported by new emerging business models that have been stealing margins away from traditional players and driving stronger margins for themselves through tighter relationships with their customers. Also consider the dynamic where suppliers and customers are turning into competitors by leveraging virtual manufacturing and easily accessible outsourcing deals.

PROCUREMENT is not traditionally considered a sexy function for ambitious business leaders. The book first attempts to dilute the myth by expanding on the career trajectory of some groundbreaking corporate leaders whose visible rise up to the top of the world’s largest and the most valued corporations began interestingly in a procurement leadership role. In almost all of those cases, these leaders made a significant impact in reducing operating costs for their companies by bringing new ideas and approaches to age old procurement practices, thinking of suppliers as extensions of their enterprise value creation chain, rather than as antagonists This ecosystem mindset tied an entire set of players into mutually beneficial relationships, while rethinking the linear supplier-buyer relationship entirely.

The authors set the pace quite early on in the book by spelling out it’s core message and the case for change right in the first few pages:

“Just 1% of the CEOs time is spent with the company’s suppliers. Odd, considering that over 50% of a company’s budget is spent on suppliers”. Clearly, the procurement function is deeply misunderstood across the company.

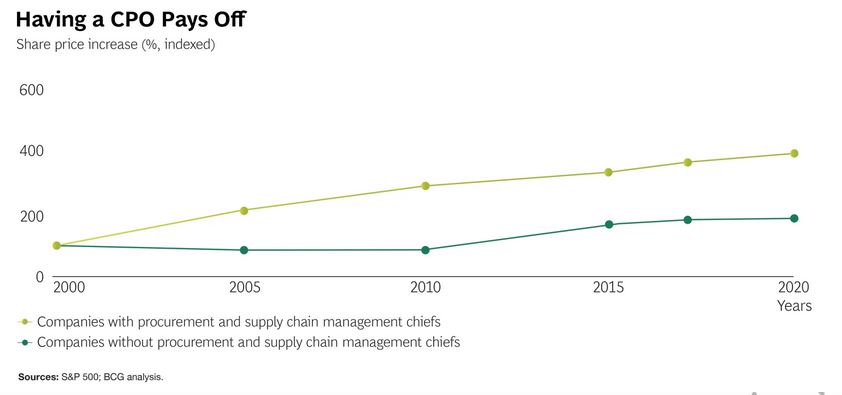

They make the case for designating the chief procurement officer role as a strategic one in the company. Failing to do so risks a serious loss of strategic commercial intelligence that comes from relationships with their suppliers.

CEOs who empower their chief procurement officer and procurement function can leap ahead of their rivals. By using savvy supplier relationship management to make the most of suppliers’ expertise and resources, procurement executives can contain costs, drive innovation, maximize product and service quality, meet ESG expectations of investors, accelerate their time to market, and strengthen supply chain resilience.

A VARIETY OF SUPPLY CHAIN DYNAMICS IN PLAY TODAY

Dynamics of supply chains vary significantly from manufacturing automotive to semiconductors to pharmaceuticals to defense procurement to smartphones and computers – the relative importance to the buyer, the concentration of revenues, the inter-relationships, bargaining powers. We learn that those

dynamics have been evolving and so are the rules of engagement and the strategies for negotiating procurement arrangements. In the most recent times, an entirely new class of suppliers – technology startups, have emerged requiring a departure from the tradition contracting processes buyers have followed traditionally with their larger suppliers.

In the automotive industry for example, procurement techniques for internal combustion engine cars was pioneered by Ford and GM, with some help from defense industry demands during world war II. The superstar John McNamara drove many new techniques to identify cost-saving opportunities through procurement.

With the transition towards Electric Vehicle (EVs) however, many of those accepted practices are giving way to entirely new procurement approaches, new supply chains and attendant new challenges brought on by geopolitical events. Tesla provides a good example of how the company controls the IP vertical stack much like the way Apple does, even though Apple practically does not make any of the physical components of its products, nor does it assemble them. And Tesla’s approach is a departure from the accepted ways of the automotive industry today. Manufacture of EVs entail procuring a far higher share of software and electronic components that handle electrical power management, battery management, passenger infotainment and fundamental guidance system of the car, than those for its physical motion. The supply chain challenges and transformation opportunities follow suit too. So do partnering strategies.

Product tear-downs and should-cost analysis are still the leading edge techniques companies used not only to identify areas for savings on materials, but also to generate ideas for simplifying the core design of products themselves. Doing so opens up a wider range of potential suppliers that can handle a component with less demanding specifications, thereby reducing total dependence on a small set of those highly experienced suppliers capable of making them.

HOW ARE BUYER-SUPPLIER RELATIONSHIPS EVOLVING

Many suppliers are responding to the situation by looking strategically ahead of their customers and making new value-offers that change the traditional supplier-buyer relationship dynamics by taking over significant portions of their operations and operating them as a service on behalf of their customers.

Another set of suppliers emboldened by data insight and deep understanding of their customers have developed models that enable them to quantify their risk in the event of sub-optimal performance. They are moving ahead with new value offers to customers that shares their risk while participating in upside gains of the customer.

More and more suppliers of industrial equipment have begun to face the existential reality of permanently shrinking margins on their physical products and have been aggressively positioning themselves to generate more and more of their future revenue from services and software solutions.

OEMS are no longer companies kept in arms-length relationships to negotiate more advantageous procurement contracts. They are forging tighter data-enabled relationships of their own with their customers. In addition, a wave of mergers and acquisitions among OEMs have also reduced the available pool of suppliers of many strategically significant items, and thereby lower bargaining power come procurement contracting time. One must mention, this change in relationships has been more visible in the high technology space where speed to innovation and going to market reward successful companies with huge premiums.

NEW CONCEPTS AND APPROACHES TO PROCUREMENT

Traditional procurement methods haven’t lost their relevance in the vast majority of industries and buying situations.

However, the processes and dynamics that underlie procurement are becoming more efficient and vastly better informed by use of big data and bleeding edge technologies such as AI-based tools. We also get a sense of the volume of data that is generated from procurement deals and the goldmine of data available from long years of procurement arrangements that provide an opportunity for companies to recognize and take advantage of patterns to make the buying process and cost-saving strategies more efficient.

AI-enabled tools are not only helping find discounts that remained unpaid, new savings opportunities in raw materials costs that were overlooked, even prescribe the most appropriate negotiation strategies for a supplier type.

One such exciting tool is presented by the authors in their book. Best described by the metaphor of a chessboard, the tool leverages game theory and its access to vast amounts of historical internal-data, as well as external databases to layout a very specific path of negotiation dynamics to achieve the buyers goal of procurement deal pricing.

CONCLUSIONS

As the global business environment learns to transition from a state of being extreme Efficiency-driven to one that is now Resiliency-focused, there are significant hidden costs that must be navigated by companies, their customers and their supplier-ecosystems. The costs are not merely of the financial kind, but also in terms of shifting relationships. Extracting value from player in the supply chain to benefit another will give way to longer term strategic relationships built not on asymmetric power negotiation dynamics but on tapping innovative ideas and accumulated technology expertise of partners on an ongoing basis. Its also an opportunity for suppliers to get ahead of buyer-supplier negotiation dynamics and move up the value-stack by making unprecedented value offers to their buyers helping change their structural dynamics to compete and lead in the new world. Supplier-buyer relationships will also become a powerful source of market and social intelligence enabling them to look over-the-horizon for new and unpredictable threats, as we saw through the global pandemic lockdown. Trust through the entire value chain will be more valuable than ever.

Having said that, new groundbreaking tools enabled by data and AI-enabled processes promise to streamline procurement into a lean fact-based function with an ability to find opportunities to wring out all inefficiencies and delays. Thereby generating its own funds for creating these new tools.

Artificial Intelligence has established a strong foothold in most aspects of business as an enabler for building tools that support efficiency goals across multiple dimensions – within the enterprise, and outside as a source for licensing revenues by allowing other enterprises to tap into their analytics expertise.

In order to get to that point, procurement teams must change their traditional mindset, develop a vision and roadmap that eventually morphs them into AI product expertise teams. They must also test their product-market fir by asking the following proposed questions:

– clients where it can deliver value for procurement leaders

– total $value of procurement budgets it can potentially impact with better decision-making

– targeted savings goals it can deliver on successfully for clients

– datasets (internal & public) it can leverage for AI “training”.

– volume (& BOM scope line-items) of a client’s historical procurement data available for training purposes

– Identify decision-areas (or tree-branches) where the tool did not perform as anticipated

– A reasonable monetization plans for the tool, independently of client engagements.

About the author

Praas Chaudhuri is CEO & Principal Industry Analyst supporting Industrial Autonomy, Intelligent Cities and the broader Digital Transformation markets. The firm’s research scope covers most major equipment companies in industrial manufacturing, mining, process automation, as well as software, hardware, satellite imaging and other innovative technology players focused on building AI-enabled applications to support industrial use-cases. Based in Silicon Valley, Praas is a former strategy consultant with several additional stints in corporate planning & strategy roles at large manufacturing and technology companies. He can be reached at pchaudhuri@arcinsightpartners.com

About ArcInsight Research

ArcInsight Research works with leading global industrial companies involved in smart city infrastructure, process equipment, control software and hardware, design, simulation, operations, optimization. It is deeply plugged into the technology ecosystem – bleeding-edge startups and the investor community.

The group was founded in 2010 by consulting firm partners and senior experienced executives with deep global experience in industrial domain research, strategy consulting, technology and and investment banking. The firm aims to equip senior industry leaders with tools and perspectives to view the bigger picture and longer term over-the-horizon opportunities, and also support their strategy with a tangible path to execution.

The strategy advisory approach offered by ArcInsight Partners is a valuable partnership opportunity for enterprises that may be either starting out on the digital transformation journey, in the midst of of transformation and looking for fresh perspectives to position themselves for a highly connected algorithm driven world.

Some of our past advisory engagements have included assisting clients –

– Validate transformation goals and its transformation journey

– Assess new target markets; Validate TAM and growth rates

– Validate drivers for new business model; Transition strategy to SaaS / Subscription models

– Design new service opportunities

– Build monetization and revenue models;

– Map in-house competencies; Sales strategy and key account coverage

– Structure appropriate partner ecosystems for effective value delivery

– Due-diligence for potential acquisition & partnership targets; Assess deal valuations